IDFC OVERNIGHT FUND

An open-ended Debt Scheme investing in overnight securities.

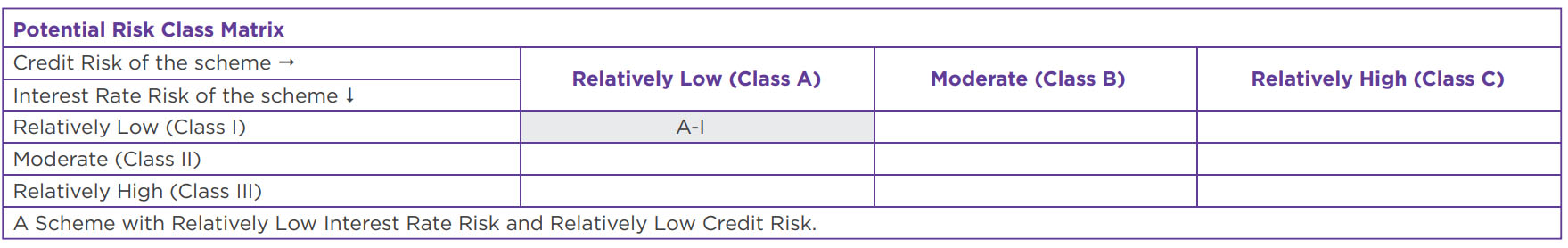

A Scheme

with Relatively Low Interest Rate Risk and Relatively Low Credit Risk

IDFC OVERNIGHT FUND

An open-ended Debt Scheme investing in overnight securities.

A Scheme

with Relatively Low Interest Rate Risk and Relatively Low Credit Risk

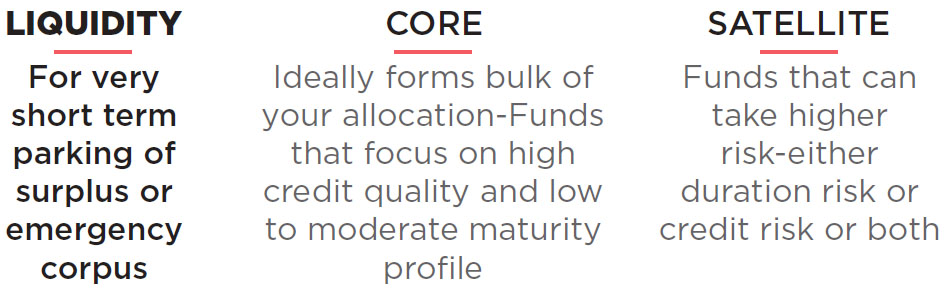

• Fund invests in instruments that have just residual

maturity of 1 day. Thereby offering investors one of

the lowest volatility product

• It also has high credit quality instruments and is

suitable for building your emergency corpus.

• A no exit load fund where you can park your surplus

temporarily – suitable to form part of ‘Liquidity’

bucket

FUND FEATURES: (Data as on 30th November'21)

Nature: Overnight

Monthly Avg AUM: Rs1,482.66 Crores

Inception Date: 18th January 2019

Fund Manager:

Mr. Brijesh Shah

(w.e.f. 1st February 2019)

Standard Deviation (Annualized): 0.05%

Modified duration: 1 day

Average Maturity: 1 day

Macaulay Duration: 1 day

Yield to Maturity: 3.34%

Benchmark: Nifty 1D Rate Index

Minimum Investment Amount: Rs5,000/- and any amount thereafter.

Exit Load: Nil

Options Available: Growth, IDCW@

- Daily (Reinvestment), Weekly

(Reinvestment), Monthly IDCW@ &

Periodic (Reinvestment, Payout and

Sweep facility).

@Income Distribution cum capital withdrawal

| PORTFOLIO | (30 November 2021) |

| Name | Rating | Total(%) |

| Clearing Corporation of India Ltd | 99.50% | |

| TRI Party Repo Total | 99.50% | |

| Net Current Asset | 0.50% | |

| Grand Total | 100.00% |

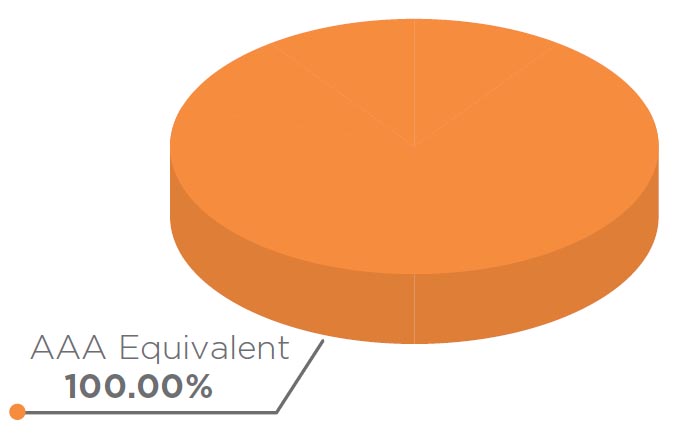

ASSET QUALITY

POTENTIAL RISK CLASS MATRIX

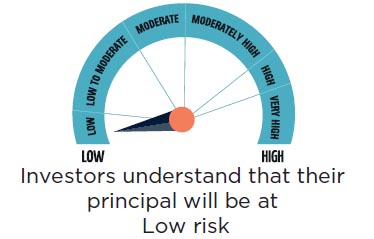

RISKOMETER

Scheme risk-o-meter

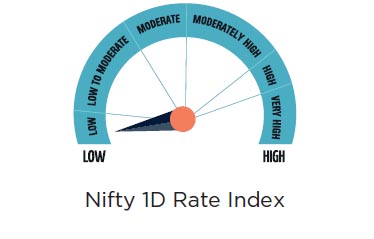

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To generate short term optimal returns in line with overnight

rates and high liquidity

• To invest in money market and debt instruments, with maturity of 1 day

*Investors should consult their financial advisors if in doubt

about whether the product is suitable for them.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |