IDFC ARBITRAGE FUND

An open ended scheme investing in arbitrage opportunities

IDFC ARBITRAGE FUND

An open ended scheme investing in arbitrage opportunities

WHAT IS ARBITRAGE?

Buying in one market and selling in another simultaneously to take

advantage of a temporary price differential is called arbitrage.

For instance, if you could buy A in Gujarat at ₹ 100 and sell it in Mumbai

simultaneously at ₹ 101, you could make ₹ 1 profit at very low risk. This

opportunity arises out of market inefficiency and is the basis of every arbitrage trade.

WHAT IS ARBITRAGE FUND?

• The fund invests in arbitrage opportunities in the cash and the derivative

segments of the equity markets. It aims to capture the spread (Cost of

Carry) between the cash and futures market by simultaneously executing

buy (in the cash market) and sell (in the futures market) trades.

• The fund follows a strategy of taking market neutral (equally offsetting

because the stocks are bought and sold at the same time) positions in

the equity market making it a low risk product irrespective of the

movements in equity market.

ADVANTAGE

• Low risk vis-à-vis Equity Funds:

As the fund takes market neutral stance (hedges its equity exposure) and

doesn’t take any directional calls, it is a low risk product versus pure equity

funds.

WHO IS THIS FUND FOR?

• Investors with a low to medium risk appetite.

• Investors who want to earn similar to risk-free returns.

FUND FEATURES: (Data as on 31st December'20)

Category:Arbitrage

Monthly Avg AUM: Rs6,903.34 Crores

Inception Date: 21st December 2006

Fund Manager:

Equity Portion : Mr. Yogik Pitti (w.e.f. 27th June 2013),

Mr.

Arpit Kapoor (w.e.f. 1st March 2017)

& Debt Portion : Mr. Harshal Joshi (w.e.f. 20th October 2016)

Standard Deviation (Annualized): 0.83%

Benchmark: Nifty 50 Arbitrage Index$

Minimum Investment Amount: Rs100/- and any amount thereafter

Exit Load: 0.25% if redeemed / switched-out within 1 month from the date of allotment (w.e.f 01st July 2016)

SIP Frequency: Monthly (Investor

may choose any day of the month

except 29th, 30th and 31st as the date

of instalment.)

Options Available: Growth, Dividend -

(Payout, Reinvestment and Sweep

(from Equity Schemes to Debt

Schemes only)) - Monthly & Annual

PORTFOLIO STANCE

As of 31st December 2020

Currently we are deployed around 67.96% in arbitrage opportunities.

| PORTFOLIO | (31 December 2020) |

| DIVIDEND HISTORY: |

| IDFC Arbitrage Fund | ||||

| Regular Plan | Direct Plan | |||

| Record Date | Record Date Nav (Rs.) | Dividend Per Unit (Rs.) | Record Date Nav (Rs.) | Dividend Per Unit (Rs.) |

| 28-Dec-20 | 12.7976 | 0.02 | 13.3825 | 0.02 |

| 25-Nov-20 | 12.7981 | 0.02 | 13.3738 | 0.02 |

| 28-Oct-20 | 12.7970 | 0.02 | 13.3648 | 0.02 |

| 28-Sep-20 | 12.7696 | 0.02 | 13.3279 | 0.02 |

| 31-Aug-20 | 12.7531 | 0.02 | 12.7319 | 0.02 |

| 28-July-20 | 12.7405 | 0.02 | 13.2805 | 0.02 |

| 26-Jun-20 | 12.7768 | 0.03 | 13.3091 | 0.03 |

| 28-May-20 | 12.8134 | 0.04 | 13.3390 | 0.04 |

| 28-Apr-20 | 12.7521 | 0.03 | 13.2666 | 0.03 |

| 20-Mar-20 | 12.7750 | 0.08 | 13.2791 | 0.08 |

| 20-Feb-28 | 12.8568 | 0.05 | 13.3580 | 0.05 |

| 20-Jan-28 | 12.8022 | 0.05 | 13.2922 | 0.05 |

| 19-Dec-27 | 12.7924 | 0.05 | 13.2740 | 0.06 |

| 19-Nov-28 | 12.8178 | 0.05 | 13.2930 | 0.05 |

| 19-Oct-30 | 12.8256 | 0.05 | 13.2938 | 0.05 |

Dividends have been rounded off till 2 decimals

Face Value per Unit (in ₹) is 10

Dividend is not guaranteed and past performance may or may not be sustained in future.

Pursuant to payment of dividend, the NAV of the scheme would fall to the extent of payout and statutory

levy (as applicable).

Source: ICRA MFI Explorer

First Business Receivables Trust- wt. avg. mat: 2.06 years

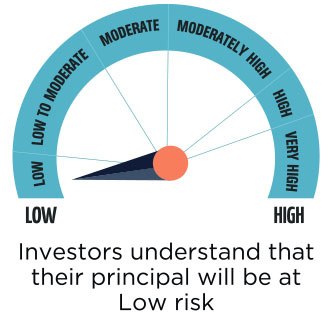

RISKOMETER

This product is suitable for investors who are seeking*:

• To generate low volatility returns over short to medium term

• Investments predominantly in arbitrage opportunities in the cash

and derivative segments of the equity markets with balance exposure

in debt and money market instruments.

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

$The benchmark has been changed from CRISIL Liquid Fund Index to Nifty 50 Arbitrage Index w.e.f. April 01, 2018

Ratios calculated on the basis of 3 years history of monthly data.The above mentioned is the current strategy of the Fund Manager. However, asset allocation and investment strategy shall be within broad parameters of Scheme Information Document.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |