IDFC TAX ADVANTAGE (ELSS) FUND

IDFC TAX ADVANTAGE (ELSS) FUND

An open ended equity linked saving scheme with a

statutory lock in of 3 years and tax benefit

The Fund is an Equity Linked Savings

Scheme (ELSS) that aims to generate long

term capital growth from a diversified

equity portfolio and enables investors to

avail of a deduction from total income, as

permitted under the Income Tax Act, 1961.

OUTLOOK

• With the spread of the pandemic and the lockdown

during Q1 FY21, earnings for the year FY21 were sharply

downgraded.

• However, the swifter than expected economic recovery

led to a more robust Q2 FY21.

• Upgrades exceeded downgrades 3x, a rarity, after years

of earnings disappointment.

• FY21 estimates, quickly rebounded from negative to

positive territory, despite the Q1 debacle.

• The fall during Mar’20 lasted less than 35 trading days,

erasing between 36-43% across the indices – Large, Mid

and Small Caps. Supportive action from Central Banks was

quicker.

• As investors searched for stable earnings, rotation from

one sector to another, as exhibited from Apr-Dec’20

phase was evident.

• Staples after outperforming in Mar-Apr, have

underperformed since then. Pharma and IT services

outperformed during May-Sept; Banks/NBFC, after

underperforming from Mar-Sept,20; outperformed during

Oct-Dec’20.

• After the debacle of Mar’20, Small caps outshone the rest

of the market – for the first time since CY17.

• If economic recovery is robust and RBI does not move

aggressively into high real interest zone, Small caps could

benefit the most.

FUND FEATURES : (Data as on 31st December'20)

Category: ELSS

Monthly Avg AUM: Rs2,627.26 Crores

Inception Date: 26th December 2008

Fund Manager:

Mr. Daylynn Pinto (w.e.f. 20/10/2016)

Other Parameters:

Beta: 1.14

R Square: 0.95

Standard Deviation (Annualized): 26.23%

Benchmark: S&P BSE 200 TRI

Minimum Investment Amount: Rs500/-

Exit Load: Nil

SIP Frequency Monthly (Investor

may choose any day of the month

except 29th, 30th and 31st as the date

of instalment.)

Options Available: Growth, Dividend

- Payout and Sweep (from Equity

Schemes to Debt Schemes Only)

| PLAN | DIVIDEND RECORD DATE | ₹/UNIT | NAV |

| REGULAR | 27-Mar-19 | 0.37 | 16.7300 |

| 27-Sep-18 | 0.48 | 16.8600 | |

| 09-Feb-18 | 0.68 | 18.6811 | |

| DIRECT | 27-Mar-19 | 0.58 | 20.5000 |

| 27-Sep-18 | 0.52 | 20.5200 | |

| 09-Feb-18 | 0.82 | 22.5603 |

Dividend is not guaranteed and past performance may or may not be sustained in future. Pursuant to payment of dividend, the NAV of the scheme would fall to the extent of payout and statutory levy (as applicable).

| PORTFOLIO | (31 December 2020) |

| Name | % of NAV |

| Equity and Equity related Instruments | 97.97% |

| Banks | 15.92% |

| ICICI Bank | 7.19% |

| HDFC Bank | 4.29% |

| State Bank of India | 2.77% |

| RBL Bank | 1.68% |

| Software | 14.34% |

| Infosys | 6.56% |

| Mastek | 2.58% |

| Birlasoft | 2.40% |

| HCL Technologies | 1.59% |

| KPIT Technologies | 1.22% |

| Pharmaceuticals | 9.29% |

| IPCA Laboratories | 2.12% |

| Dr. Reddy's Laboratories | 1.94% |

| Aurobindo Pharma | 1.72% |

| Cipla | 1.53% |

| Lupin | 1.46% |

| Dishman Carbogen Amcis | 0.52% |

| Consumer Durables | 5.92% |

| Voltas | 1.46% |

| Crompton Greaves Consumer Electricals | 1.42% |

| Greenpanel Industries | 1.14% |

| Greenply Industries | 1.13% |

| Greenlam Industries | 0.46% |

| Khadim India | 0.31% |

| Petroleum Products | 5.35% |

| Reliance Industries | 4.07% |

| Bharat Petroleum Corporation | 1.28% |

| Auto Ancillaries | 4.85% |

| MRF | 1.70% |

| Bosch | 1.29% |

| Minda Industries | 1.04% |

| Sandhar Technologies | 0.82% |

| Chemicals | 4.76% |

| Deepak Nitrite | 3.51% |

| Tata Chemicals | 1.25% |

| Industrial Products | 4.61% |

| Bharat Forge | 1.62% |

| Apollo Pipes | 1.26% |

| Graphite India | 1.16% |

| AIA Engineering | 0.58% |

| Construction Project | 4.42% |

| KEC International | 2.44% |

| NCC | 1.98% |

| Finance | 4.32% |

| ICICI Lombard General Insurance Company | 1.42% |

| Mas Financial Services | 1.40% |

| ICICI Securities | 1.16% |

| Magma Fincorp | 0.34% |

| Consumer Non Durables | 4.20% |

| ITC | 1.48% |

| United Spirits | 1.40% |

| Tata Consumer Products | 1.32% |

| Auto | 4.07% |

| Tata Motors | 2.06% |

| Mahindra & Mahindra | 2.02% |

| Ferrous Metals | 3.47% |

| Jindal Steel & Power | 2.29% |

| Kirloskar Ferrous Industries | 1.15% |

| Tata Steel | 0.03% |

| Telecom - Services | 3.42% |

| Bharti Airtel | 3.42% |

| Cement | 3.31% |

| UltraTech Cement | 1.48% |

| The Ramco Cements | 1.34% |

| Sagar Cements | 0.49% |

| Hotels/ Resorts and Other Recreational Activities | 1.42% |

| The Indian Hotels Company | 0.99% |

| EIH | 0.44% |

| Power | 1.33% |

| Kalpataru Power Transmission | 1.05% |

| Nava Bharat Ventures | 0.28% |

| Transportation | 1.32% |

| VRL Logistics | 1.32% |

| Construction | 1.11% |

| PSP Projects | 1.11% |

| Industrial Capital Goods | 0.54% |

| CG Power and Industrial Solutions | 0.54% |

| Preference Shares | 0.004% |

| Media & Entertainment | 0.004% |

| Zee Entertainment Enterprises | 0.004% |

| Net Cash and Cash Equivalent | 2.02% |

| Grand Total | 100.00% |

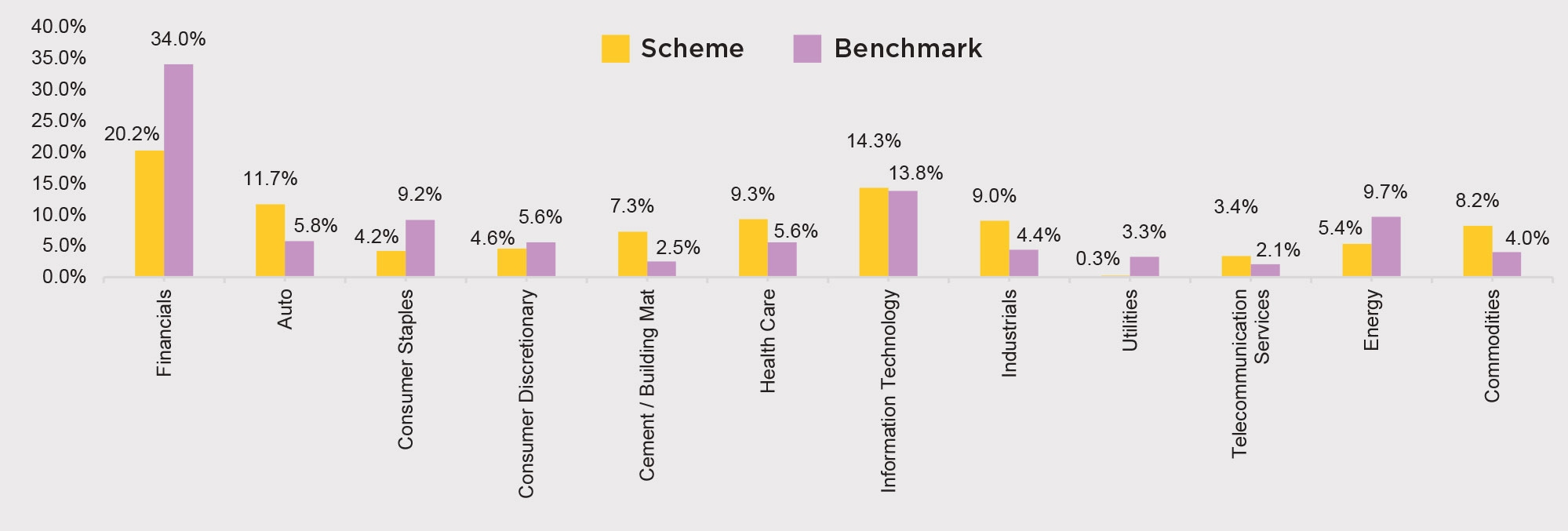

SECTOR ALLOCATION

RISKOMETER

This product is suitable for investors who are seeking*:

• To create wealth over long term

• Investment predominantly in Equity and Equity related securities

with income tax benefit u/s 80C and 3 years lock-in

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |