IDFC BANKING & PSU DEBT FUND

(The Fund (erstwhile IDFC Banking Debt Fund) has been

repositioned with effect from June 12, 2017$$)

An open ended debt scheme predominantly investing in debt

instruments of banks, Public Sector Undertakings, Public Financial

Institutions and Municipal Bonds.

IDFC BANKING & PSU DEBT FUND

(The Fund (erstwhile IDFC Banking Debt Fund) has been

repositioned with effect from June 12, 2017$$)

An open ended debt scheme predominantly investing in debt

instruments of banks, Public Sector Undertakings, Public Financial

Institutions and Municipal Bonds.

Focus on investing in high quality instrument*

FUND FEATURES: (Data as on 31st December'20)

Category: Banking and PSU

Monthly Avg AUM: Rs18,649.25 Crores

Inception Date: 7th March 2013

Fund Manager: Mr. Anurag Mittal

(w.e.f. 15th May 2017)

Standard Deviation (Annualized): 2.22%

Modified duration 1.90 years

Average Maturity: 2.15 years

Macaulay Duration: 1.99 years

Yield to Maturity: 4.44%

Benchmark: NIFTY Banking & PSU

Debt Index (w.e.f 11/11/2019)

Minimum Investment Amount: Rs5,000/- and any amount thereafter

Exit Load: Nil (w.e.f. 12th June 2017)

Options Available : Growth, Dividend -

Daily, Fortnightly, Monthly

(Reinvestment), Quarterly (Payout),

Annual (Payout) & Periodic (Payout &

Reinvestment)

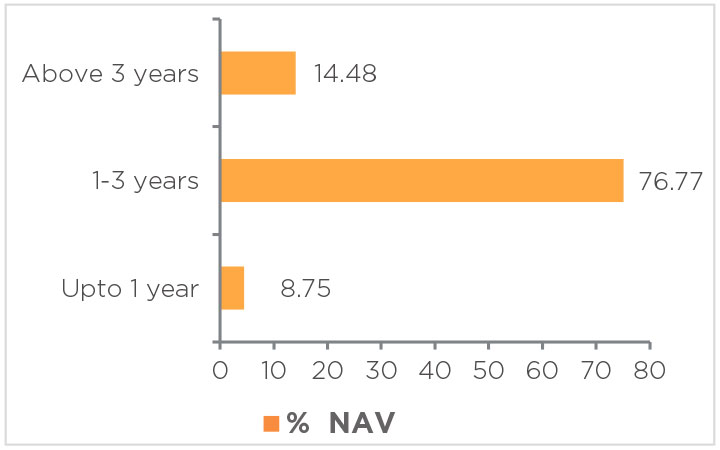

Maturity Bucket:

| PORTFOLIO | (31 December 2020) |

| Name | Rating | Total (%) |

| Corporate Bond | 89.94% | |

| NABARD | AAA | 12.09% |

| Power Finance Corporation | AAA | 8.09% |

| REC | AAA | 7.18% |

| HDFC | AAA | 6.32% |

| LIC Housing Finance | AAA | 5.91% |

| National Highways Auth of Ind | AAA | 5.86% |

| Axis Bank | AAA | 5.80% |

| Indian Railway Finance Corporation | AAA | 5.76% |

| Hindustan Petroleum Corporation | AAA | 5.71% |

| Small Industries Dev Bank of India | AAA | 5.06% |

| National Housing Bank | AAA | 4.55% |

| Reliance Industries | AAA | 4.04% |

| Export Import Bank of India | AAA | 2.92% |

| ICICI Bank | AAA | 2.74% |

| Power Grid Corporation of India | AAA | 2.30% |

| Housing & Urban Development Corporation | AAA | 1.79% |

| NTPC | AAA | 1.42% |

| NHPC | AAA | 1.00% |

| Larsen & Toubro | AAA | 0.90% |

| Indian Oil Corporation | AAA | 0.49% |

| Tata Sons Private | AAA | 0.02% |

| Government Bond | 3.19% | |

| 7.37% - 2023 G-Sec | SOV | 1.33% |

| 7.32% - 2024 G-Sec | SOV | 0.70% |

| 6.84% - 2022 G-Sec | SOV | 0.69% |

| 5.22% - 2025 G-Sec | SOV | 0.28% |

| 7.16% - 2023 G-Sec | SOV | 0.18% |

| Certificate of Deposit | 1.79% | |

| Export Import Bank of India | A1+ | 0.87% |

| Axis Bank | A1+ | 0.77% |

| Bank of Baroda | A1+ | 0.14% |

| Zero Coupon Bond | 0.62% | |

| LIC Housing Finance | AAA | 0.62% |

| Commercial Paper | 0.58% | |

| Export Import Bank of India | A1+ | 0.56% |

| Reliance Industries | A1+ | 0.02% |

| State Government Bond | 0.47% | |

| 9.25% Haryana SDL - 2023 | SOV | 0.32% |

| 8.62% Maharashtra SDL - 2023 | SOV | 0.06% |

| 7.93% Chattisgarh SDL - 2024 | SOV | 0.06% |

| 5.93% ODISHA SDL - 2022 | SOV | 0.02% |

| 8.48% Tamilnadu SDL - 2023 | SOV | 0.01% |

| 8.10% TAMIL NADU SDL - 2023 | SOV | 0.003% |

| Treasury Bill | 0.17% | |

| 182 Days Tbill - 2021 | SOV | 0.17% |

| Net Cash and Cash Equivalent | 3.23% | |

| Grand Total | 100.00% |

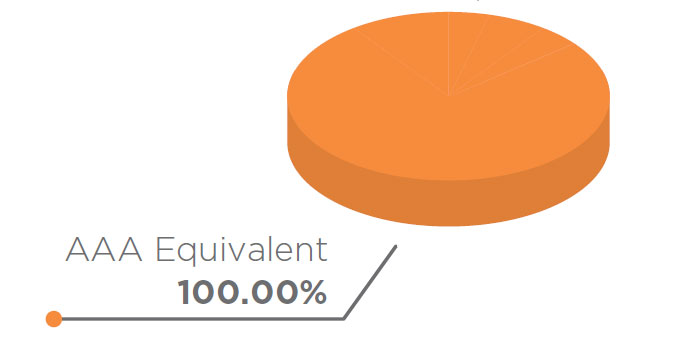

ASSET QUALITY

RISKOMETER

This product is suitable for investors who are seeking*:

• To generate optimal returns over short to medium term

• Investments predominantly in debt & money market instruments

issued by PSU, Banks & PFI

*Investors should consult their financial advisors if in doubt

about whether the product is suitable for them.

$$For details please refer Notice ( https://www.idfcmf.com/uploads/090520171306No-18-Change-in-Scheme-features-of-IDFC-Banking-Debt-Fund.pdf )

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |