IDFC Bond Fund - Income Plan

(The fund has been repositioned to Medium to Long Term category w.e.f.

July 12, 2018)

(previously known as IDFC Super Saver Income Fund – Investment Plan)

An open ended medium term debt scheme investing in instruments such that

the Macaulay duration of the portfolio is between 4 years and 7 years.

IDFC Bond Fund - Income Plan

(The fund has been repositioned to Medium to Long Term category w.e.f.

July 12, 2018)

(previously known as IDFC Super Saver Income Fund – Investment Plan)

An open ended medium term debt scheme investing in instruments such that

the Macaulay duration of the portfolio is between 4 years and 7 years.

An actively managed bond fund (with Macaulay duration between 4 to 7 years) which seeks to invest in highly rated money market and debt instruments (including government securities) and aims to generate stable long term returns through mix of accrual income and capital appreciation.

OUTLOOK

• If the factors supporting India’s cyclical rebound come to fruition, a lot of

macro-economic headaches feared at the beginning of the year will ease.

Thus some of the fiscal inflexibilities and associated risks of sovereign rating

downgrades will abate, the external account will build even further buffers

as capital flows remain strong, and hopefully India’s appeal will percolate to

global fixed income investors as well.

• Monetary policy will gradually move from the level of emergency level

accommodation today to one of still high accommodation. This will likely be

a slow process and will involve more discretionary adjustments to the price

of liquidity rather than the quantity of it.

• Yield curves will gradually bear flatten. It is very likely that the bulk of this

adjustment will be made by the very front end rates. This is not to say that

long end rates won’t have to adjust. Rather, the quantum of adjustment

there may be of a relatively smaller magnitude when compared with rates

at the very front end.

• The starting point today is one of a very steep yield curve. Thus unlike in

normal times when the yield curve is quite flat, the decision on duration isn’t

a binary one any more. Rather, one has to examine the steepness of the

curve and position at points where the carry adjusted for duration seems to

be the most optimal.

• Credit spreads, including on lower rated assets, have compressed

meaningfully. These reflect the chase for ‘carry’ in an environment of

abundant liquidity and funds flow, as well as the relatively muted supply of

paper as companies have belt tightened and focused on cash generation.

As activity resumes over the year ahead, issuances will likely increase

thereby pressuring spreads to rise.

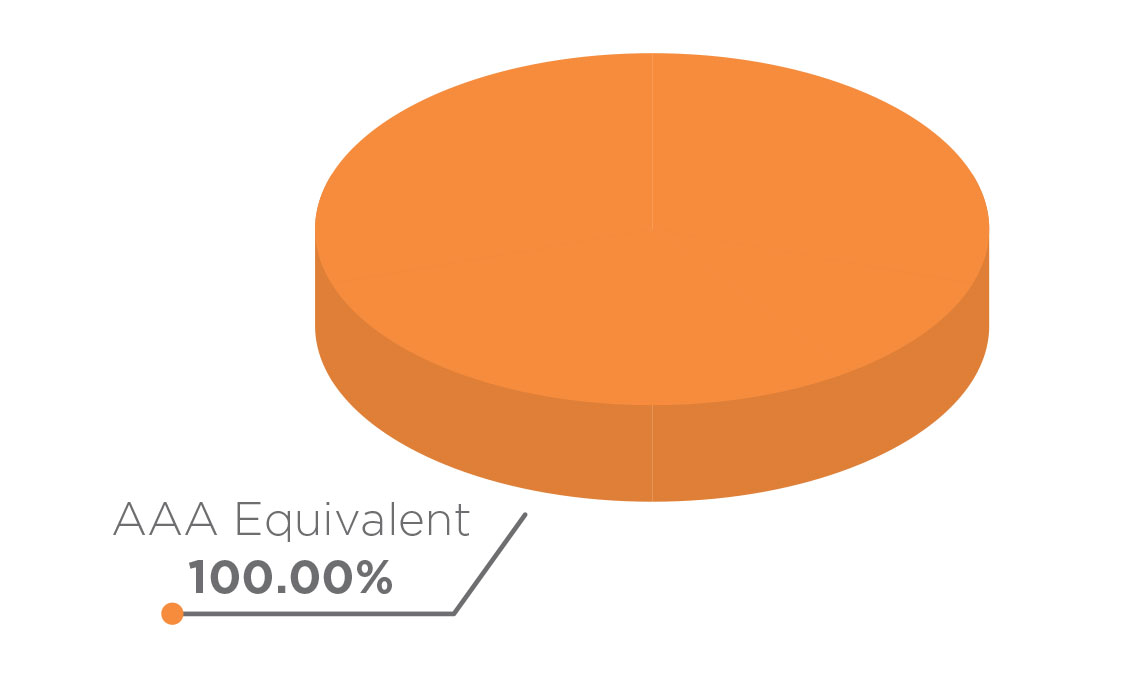

ASSET QUALITY

FUND FEATURES: (Data as on 31st December'20)

Category: Medium to Long Duration

Monthly Avg AUM: Rs701.75 Crores

Inception Date: 14th July 2000

Fund Manager:

Mr. Suyash

Choudhary (w.e.f. 15/10/2010)

Standard Deviation (Annualized): 3.92%

Modified duration 5.24 years

Average Maturity: 6.76 years

Macaulay Duration: 5.39 years

Yield to Maturity: 5.73%

Benchmark: CRISIL Composite Bond

Fund Index

Minimum Investment Amount: Rs5,000/- and any amount thereafter

Exit Load: If redeemed/switched out

within 365 days from the date of

allotment:

For 10% of investment: Nil

For remaining investment: 1%

If redeemed/switched out after 365

days from the date of allotment: Nil

Options Available : Growth, Dividend -

Quarterly, Half Yearly, Annual & Periodic

(each with payout, reinvestment and sweep

facility)

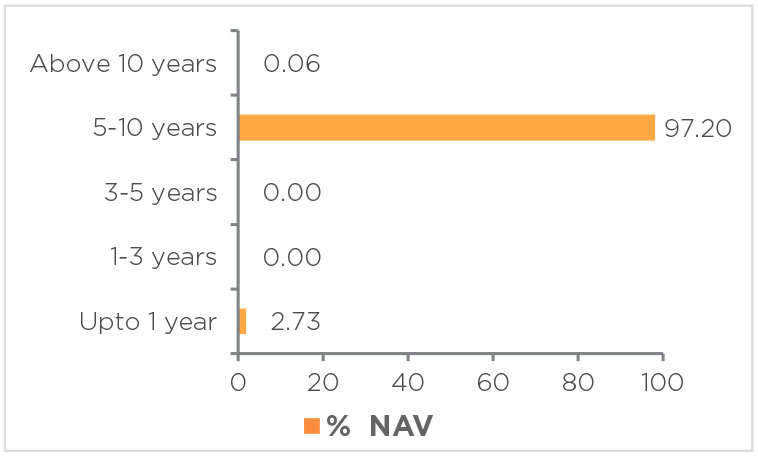

Maturity Bucket:

| PORTFOLIO | (31 December 2020) |

| Name | Rating | Total (%) |

| Government Bond | 96.46% | |

| 6.79% - 2027 G-Sec | SOV | 36.42% |

| 7.17% - 2028 G-Sec | SOV | 28.69% |

| 8.24% - 2027 G-Sec | SOV | 16.10% |

| 7.26% - 2029 G-Sec | SOV | 14.59% |

| 6.45% - 2029 G-Sec | SOV | 0.59% |

| 7.73% - 2034 G-Sec | SOV | 0.06% |

| Corporate Bond | 0.81% | |

| REC | AAA | 0.81% |

| Net Cash and Cash Equivalent | 2.73% | |

| Grand Total | 100.00% |

RISKOMETER

This product is suitable for investors who are seeking*:

• To generate optimal returns over long term

• Investments in Debt & Money Market securities such that the

Macaulay duration of the portfolio is between 4 years and 7 years

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

Standard Deviation calculated on the basis of 1 year history of monthly data

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |