IDFC CASH FUND

An open ended liquid scheme

The Fund aims to invest in high quality debt and money market instruments with high liquidity and seeks to generate accrual income with low volatility.

IDFC CASH FUND

An open ended liquid scheme

The Fund aims to invest in high quality

debt and money market instruments

with high liquidity and seeks to generate

accrual income with low volatility.

FUND FEATURES: (Data as on 31st December'20)

Category: Liquid

Monthly Avg AUM: Rs10,449.23 Crores

Inception Date: 2nd July 2001

Fund Manager:

Mr. Harshal Joshi

(w.e.f. 15th September 2015) & Mr.

Anurag Mittal (w.e.f. 09th November

2015)

Standard Deviation (Annualized): 0.31%

Modified duration 33 days

Average Maturity: 34 days

Macaulay Duration: 34 days

Yield to Maturity: 2.78%

Benchmark: Crisil Liquid Fund Index

Minimum Investment Amount: Rs100/- and any amount thereafter

Options Available : Growth & Dividend

Option - Daily (Reinvest), Weekly

(Reinvest), Monthly (Payout,Reinvest and

Sweep), Periodic (Payout,Reinvest and

Sweep).

Exit Load*:

| Investor exit upon subscription | Exit load as a % of redemption proceeds |

| Day 1 | 0.0070% |

| Day 2 | 0.0065% |

| Day 3 | 0.0060% |

| Day 4 | 0.0055% |

| Day 5 | 0.0050% |

| Day 6 | 0.0045% |

| Day 7 onwards | 0.0000% |

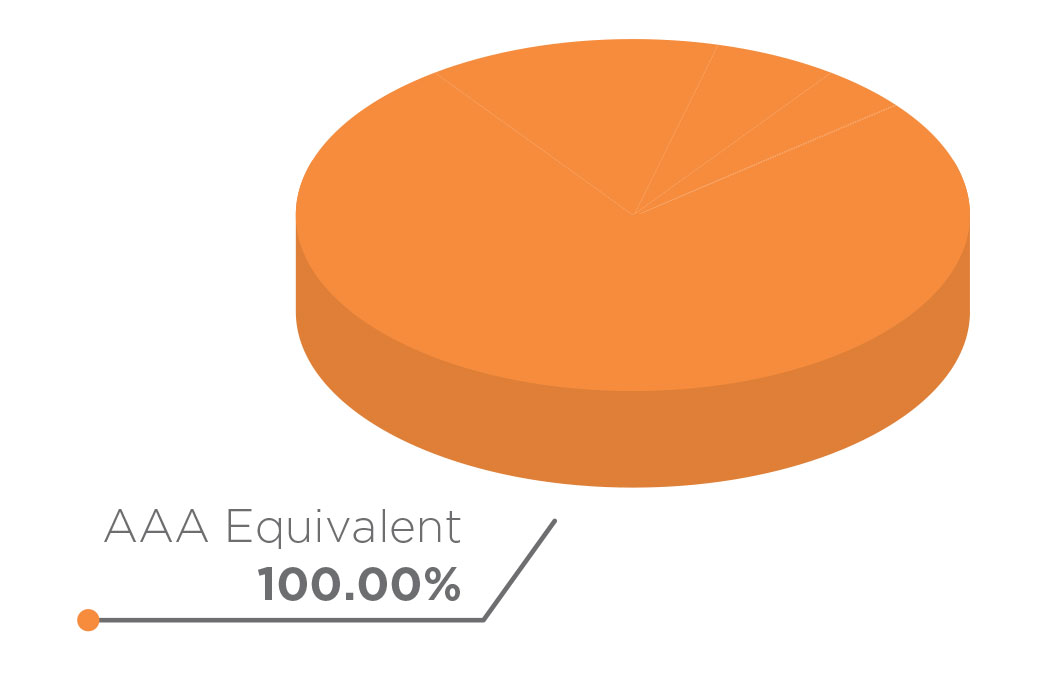

ASSET QUALITY

| PORTFOLIO | (31 December 2020) |

| Name | Rating | Total (%) |

| Commercial Paper | 43.55% | |

| Reliance Industries | A1+ | 11.21% |

| Reliance Retail Ventures | A1+ | 5.50% |

| HDFC | A1+ | 3.74% |

| UltraTech Cement | A1+ | 3.73% |

| Kotak Mahindra Prime | A1+ | 3.53% |

| Sundaram Finance | A1+ | 3.52% |

| NABARD | A1+ | 3.30% |

| NTPC | A1+ | 3.08% |

| Oil & Natural Gas Corporation | A1+ | 2.20% |

| ICICI Securities | A1+ | 1.76% |

| Kotak Mahindra Investments | A1+ | 1.10% |

| Larsen & Toubro | A1+ | 0.88% |

| Treasury Bill | 24.93% | |

| 91 Days Tbill - 2021 | SOV | 20.52% |

| 182 Days Tbill - 2021 | SOV | 4.41% |

| Certificate of Deposit | 0.66% | |

| NABARD | A1+ | 0.44% |

| Small Industries Dev Bank of India | A1+ | 0.22% |

| Net Cash and Cash Equivalent | 30.86% | |

| Grand Total | 100.00% |

RISKOMETER

This product is suitable for investors who are seeking*:

• To generate short term optimal returns with stability and high liquidity

• Investments in money market and debt instruments, with maturity

up to 91 days

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |