IDFC CREDIT RISK FUND

(Previously known as IDFC Credit Opportunities Fund)

An open ended debt scheme predominantly investing in AA and below rated corporate bonds

IDFC CREDIT RISK FUND

(Previously known as IDFC Credit Opportunities Fund)

An open ended debt scheme predominantly investing

in AA and below rated corporate bonds

IDFC Credit Risk Fund fund aims to provide an optimal risk-reward profile to investors by focusing on companies with well-run management and evolving business prospects or good businesses with improving financial profile.

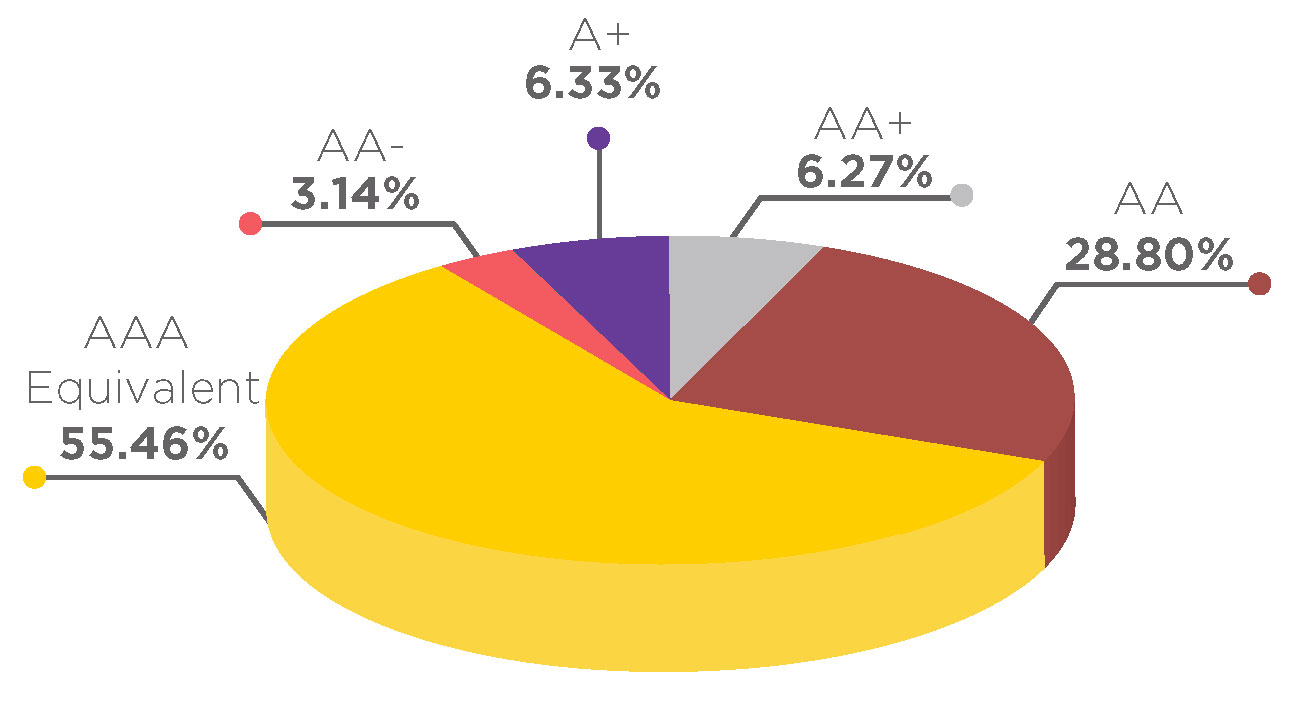

ASSET QUALITY

FUND FEATURES: (Data as on 31st December'20)

Category: Credit Risk

Monthly Avg AUM: Rs806.34 Crores

Inception Date: 3rd March 2017

Fund Manager: Mr. Arvind Subramanian (w.e.f. 03rd March 2017)

Standard Deviation (Annualized): 3.25%

Modified duration: 2.78 years

Average Maturity: 3.58 years

Macaulay Duration: 2.94 years

Yield to Maturity: 7.06%

Benchmark: 65% NIFTY AA Short

Duration Bond Index + 35% NIFTY

AAA Short Duration Bond Index

(w.e.f 11/11/2019)

Exit Load: 1% if redeemed/switched

out within 365 days from the date of

allotment

Options Available: Growth,

Dividend - Quarterly, Half yearly,

Annual and Periodic (Payout,

Reinvestment & Sweep facility)

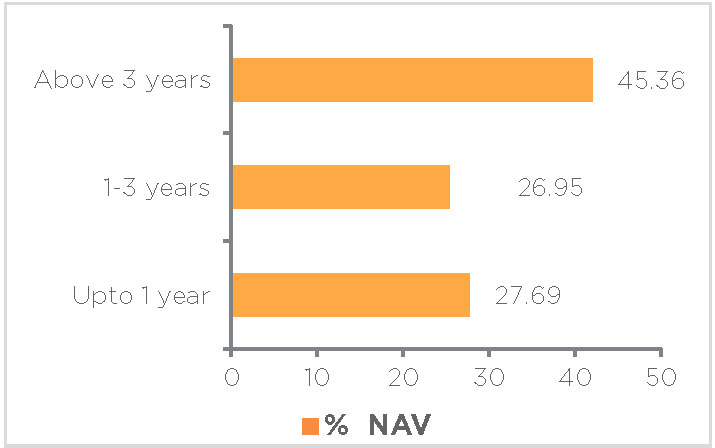

Maturity Bucket:

| PORTFOLIO | (31 December 2020) |

| Name | Rating | Total (%) |

| Corporate Bond | 49.94% | |

| Reliance Industries | AAA | 6.42% |

| Tata Power Renewable Energy* | AA(CE) | 6.40% |

| Afcons Infrastructure | A+ | 6.33% |

| National Highways Auth of Ind | AAA | 6.06% |

| IndusInd Bank@ | AA | 5.75% |

| Bank of Baroda@ | AA+ | 5.64% |

| Indian Bank@ | AA | 3.70% |

| Bank of Baroda@ | AA | 3.17% |

| Tata Steel | AA- | 3.14% |

| Indian Railway Finance Corporation | AAA | 1.36% |

| HDFC | AAA | 0.68% |

| Tata Power Company | AA | 0.64% |

| State Bank of India@ | AA+ | 0.63% |

| Government Bond | 18.60% | |

| 7.17% - 2028 G-Sec | SOV | 15.88% |

| 7.59% - 2026 G-Sec | SOV | 2.72% |

| PTC | 9.23% | |

| First Business Receivables Trust^ | AAA(SO) | 9.23% |

| Zero Coupon Bond | 9.13% | |

| Aditya Birla Fashion and Retail | AA | 9.13% |

| Net Cash and Cash Equivalent | 13.11% | |

| Grand Total | 100.00% |

(PTC originated by Reliance Industries Limited)

#Corporate Guarantee from Tata Power

@AT1 Bonds under Basel III

RISKOMETER

This product is suitable for investors who are seeking*:

• To generate optimal returns over medium to long term

• To predominantly invest in a portfolio of corporate debt

securities across the credit spectrum

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

Gsec/SDL yields have been annualized wherever applicable

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |