IDFC GOVERNMENT SECURITIES FUND-INVESTMENT PLAN

(Government Securities Fund PF will be merged into

Government Securities Fund IP w.e.f. May 7, 2018)

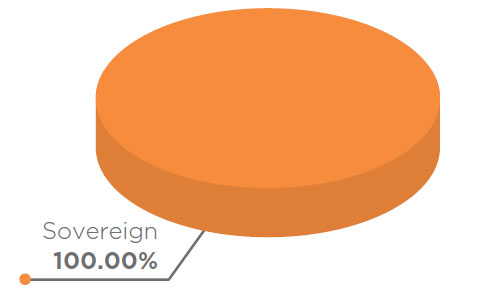

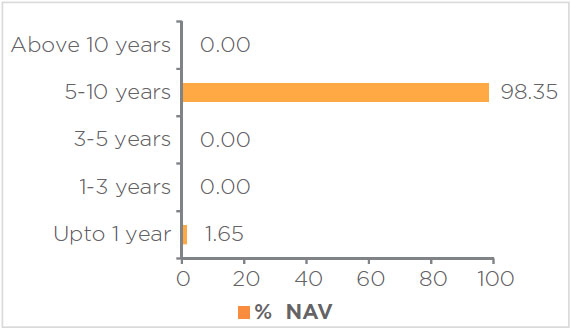

An open ended debt scheme investing in government

securities across maturities

IDFC GOVERNMENT SECURITIES FUND-INVESTMENT PLAN

(Government Securities Fund PF will be merged into

Government Securities Fund IP w.e.f. May 7, 2018)

An open ended debt scheme investing in government

securities across maturities

A dedicated gilt fund with an objective to generate optimal returns with high liquidity by investing in Government Securities.

Standard Deviation calculated on the basis of 1 year history of monthly data

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |