IDFC OVERNIGHT FUND

An Open-ended Debt Scheme investing in overnight securities

IDFC OVERNIGHT FUND

An Open-ended Debt Scheme investing in overnight securities

The fund aims to generate short term optimal returns in line with overnight rates

FUND FEATURES: (Data as on 31st December'20)

Nature: Overnight

Average AUM : Rs1,844.18 Crores

Inception Date: 18th January 2019

Fund Manager:

Mr. Brijesh Shah

(w.e.f. 1st February 2019)

Modified duration: 1 day

Average Maturity: 1 day

Macaulay Duration: 1 day

Yield to Maturity: 2.14%

Benchmark: Nifty 1D Rate Index

Minimum Investment Amount: Rs5,000/- and any amount thereafter.

Exit Load: Nil

Options Available: Growth, Dividend

- Daily (Reinvestment), Weekly

(Reinvestment), Monthly Dividend &

Periodic (Reinvestment, Payout and

Sweep facility).

| PORTFOLIO | (31 December 2020) |

| Name | Rating | Total(%) |

| Clearing Corporation of India Ltd | 100.02% | |

| TRI Party Repo Total | 100.02% | |

| Net Current Asset | -0.02% | |

| Grand Total | 100.00% |

ASSET QUALITY

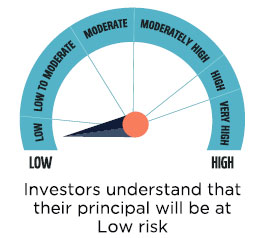

RISKOMETER

This product is suitable for investors who are seeking*:

• To generate short term optimal returns in line with overnight

rates and high liquidity

• To invest in money market and debt instruments, with maturity of 1 day

*Investors should consult their financial advisors if in doubt

about whether the product is suitable for them.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |