IDFC ULTRA SHORT TERM FUND

An open-ended ultra-short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3 to 6 months

IDFC ULTRA SHORT TERM FUND

An open-ended ultra-short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3 to 6 months

The Fund aims to invest in high quality debt and money market instruments with macaulay duration of 3 to 6 months and seeks to generate stable returns with a low risk strategy

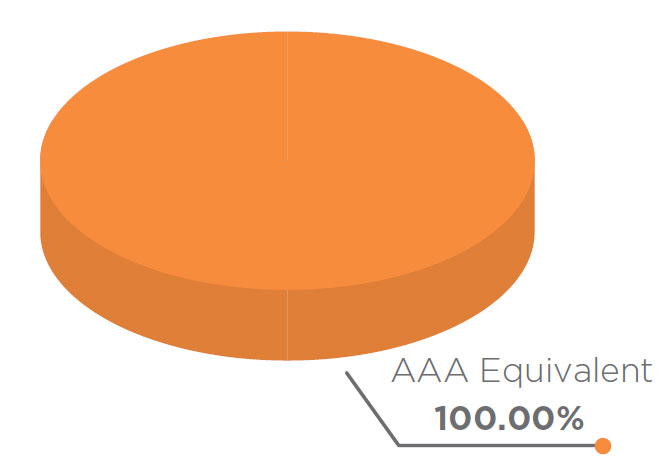

ASSET QUALITY

FUND FEATURES: (Data as on 31st December'20)

Category: Ultra Short Duration

Monthly Avg AUM: Rs5,265.18 Crores

Inception Date: 18th July 2018

Fund Manager:

Mr. Harshal Joshi (w.e.f. 18th July 2018)

Modified duration 121 days

Average Maturity: 129 days

Macaulay Duration: 125 days

Yield to Maturity: 3.20%

Benchmark: NIFTY Ultra Short

Duration Debt Index (w.e.f 01st February, 2019)

Minimum Investment Amount: Rs100/- and any amount thereafter

Exit Load: Nil

Options Available: Growth &

Dividend Option - Daily

(Reinvestment), Weekly

(Reinvestment), Monthly , Quarterly &

Periodic (each with Reinvestment,

Payout and Sweep facility).

| PORTFOLIO | (31 December 2020) |

| Name | Rating | Total (%) |

| Treasury Bill | 39.34% | |

| 182 Days Tbill - 2021 | SOV | 36.32% |

| 364 Days Tbill - 2021 | SOV | 3.02% |

| Commercial Paper | 21.77% | |

| Reliance Industries | A1+ | 7.85% |

| HDFC | A1+ | 7.20% |

| Kotak Mahindra Prime | A1+ | 4.50% |

| LIC Housing Finance | A1+ | 2.22% |

| Corporate Bond | 16.83% | |

| Small Industries Dev Bank of India | AAA | 5.54% |

| REC | AAA | 3.93% |

| NABARD | AAA | 2.74% |

| LIC Housing Finance | AAA | 2.30% |

| HDFC | AAA | 1.14% |

| Power Finance Corporation | AAA | 0.93% |

| Indian Railway Finance Corporation | AAA | 0.12% |

| Reliance Industries | AAA | 0.12% |

| State Government Bond | 7.33% | |

| 6.92% MAHARASTRA SDL - 2022 | SOV | 2.55% |

| 8.38% Karnataka SDL - 2022 | SOV | 2.05% |

| 8.31% Karnataka SDL - 2022 | SOV | 1.33% |

| 7.9% CHHATISGARH SDL - 2021 | SOV | 0.35% |

| 8.53% Andhra Pradesh SDL - 2021 | SOV | 0.34% |

| 8.84% Gujrat SDL - 2022 | SOV | 0.12% |

| 8.90% Andhra pradesh SDL - 2022 | SOV | 0.12% |

| 8.79% Maharashtra SDL - 2021 | SOV | 0.12% |

| 7.03% Gujarat SDL - 2021 | SOV | 0.12% |

| 7.55% Odisha SDL - 2021 | SOV | 0.11% |

| 8.39% Tamilnadu SDL - 2021 | SOV | 0.11% |

| Certificate of Deposit | 6.24% | |

| Axis Bank | A1+ | 4.47% |

| Small Industries Dev Bank of India | A1+ | 1.69% |

| ICICI Bank | A1+ | 0.09% |

| Net Cash and Cash Equivalent | 8.50% | |

| Grand Total | 100.00% | |

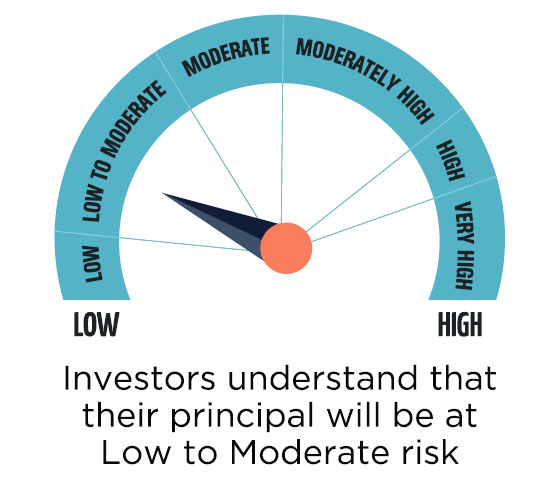

RISKOMETER

This product is suitable for investors who are seeking*:

• To generate returns over short-term investment horizon with a low risk

strategy

• To invest in debt and money market instruments

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |