IDFC NIFTY FUND

IDFC NIFTY FUND

An open ended scheme tracking Nifty 50 Index

IDFC Nifty Fund is an index fund which is managed passively by investing in proportion to the Nifty 50.

FUND FEATURES: (Data as on 30th June'21)

Category: Index

Monthly Avg AUM: Rs322.11 Crores

Inception Date: 30th April 2010

Fund Manager:

Mr. Arpit Kapoor and Sumit Agrawal (w.e.f.01/03/2017)

Other Parameters:

Beta: 0.99

R Square: 1.00

Standard Deviation (Annualized): 21.77%

Benchmark: Nifty 50 TRI

Minimum Investment Amount: Rs5,000 and any amount thereafter

Exit Load: Nil

(w.e.f. 4th February 2019)

SIP Frequency: Monthly (Investor may

choose any day of the month except

29th, 30th and 31st as the date of

instalment.)

Options Available: Growth, IDCW@

- (Payout, Reinvestment and Sweep

(from Equity Schemes to Debt Schemes

only))

@Income Distribution cum capital withdrawal

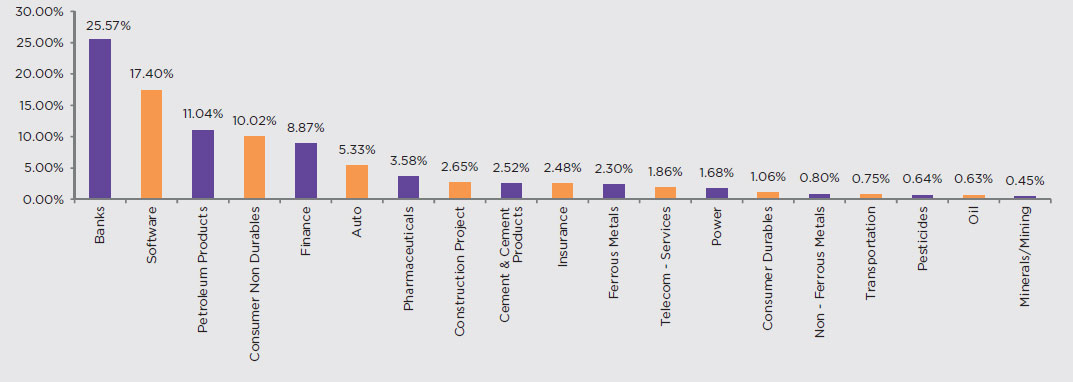

| PORTFOLIO | (30 June 2021) |

| Name of the Instrument | Ratings | % to NAV |

| Equity and Equity related Instruments | 99.63% | |

| Banks | 25.57% | |

| HDFC Bank | 9.55% | |

| ICICI Bank | 6.39% | |

| Kotak Mahindra Bank | 3.67% | |

| Axis Bank | 2.76% | |

| State Bank of India | 2.36% | |

| IndusInd Bank | 0.84% | |

| Yes Bank | 0.002% | |

| Software | 17.40% | |

| Infosys | 8.58% | |

| Tata Consultancy Services | 5.08% | |

| HCL Technologies | 1.56% | |

| Wipro | 1.18% | |

| Tech Mahindra | 0.99% | |

| Petroleum Products | 11.04% | |

| Reliance Industries | 10.00% | |

| Bharat Petroleum Corporation | 0.64% | |

| Indian Oil Corporation | 0.40% | |

| Consumer Non Durables | 10.02% | |

| Hindustan Unilever | 3.23% | |

| ITC | 2.60% | |

| Asian Paints | 1.98% | |

| Nestle India | 0.92% | |

| Tata Consumer Products | 0.66% | |

| Britannia Industries | 0.63% | |

| Finance | 8.87% | |

| HDFC | 6.53% | |

| Bajaj Finance | 2.34% | |

| Auto | 5.33% | |

| Maruti Suzuki India | 1.46% | |

| Mahindra & Mahindra | 1.09% | |

| Tata Motors | 0.89% | |

| Bajaj Auto | 0.79% | |

| Hero MotoCorp | 0.55% | |

| Eicher Motors | 0.55% | |

| Pharmaceuticals | 3.58% | |

| Sun Pharmaceutical Industries | 1.07% | |

| Dr. Reddy's Laboratories | 0.96% | |

| Divi's Laboratories | 0.82% | |

| Cipla | 0.72% | |

| Construction Project | 2.65% | |

| Larsen & Toubro | 2.65% | |

| Cement & Cement Products | 2.52% | |

| UltraTech Cement | 1.15% | |

| Grasim Industries | 0.84% | |

| Shree Cement | 0.54% | |

| Insurance | 2.48% | |

| Bajaj Finserv | 1.07% | |

| HDFC Life Insurance Company | 0.83% | |

| SBI Life Insurance Company | 0.58% | |

| Ferrous Metals | 2.30% | |

| Tata Steel | 1.33% | |

| JSW Steel | 0.97% | |

| Telecom - Services | 1.86% | |

| Bharti Airtel | 1.86% | |

| Power | 1.68% | |

| Power Grid Corporation of India | 0.87% | |

| NTPC | 0.81% | |

| Consumer Durables | 1.06% | |

| Titan Company | 1.06% | |

| Non - Ferrous Metals | 0.80% | |

| Hindalco Industries | 0.80% | |

| Transportation | 0.75% | |

| Adani Ports and Special Economic Zone | 0.75% | |

| Pesticides | 0.64% | |

| UPL | 0.64% | |

| Oil | 0.63% | |

| Oil & Natural Gas Corporation | 0.63% | |

| Minerals/Mining | 0.45% | |

| Coal India | 0.45% | |

| Corporate Bond | 0.01% | |

| NTPC | AAA | 0.01% |

| Britannia Industries | AAA | 0.005% |

| Net Cash and Cash Equivalent | 0.36% | |

| Grand Total | 100.00% |

INDUSTRY ALLOCATION

RISKOMETER

This product is suitable for investors who are seeking*:

• To create wealth over long term

• Investment in equity and equity related instruments

forming part of Nifty 50 index

*Investors should consult their financial advisors if in doubt

about whether the product is suitable for them.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |