IDFC STERLING VALUE FUND

IDFC STERLING VALUE FUND

An open ended equity scheme following a value investment strategy

IDFC Sterling Value Fund is a value

oriented fund with the current focus on

the mid and small cap segment*.

FUND PHILOSOPHY*

The focus of IDFC Sterling Value Fund has been on building a portfolio of Leader/Challengers and Emerging businesses with an emphasis on bottom up stock selection. As part of the current strategy, the portfolio looks to build on the leaders/challengers – these are the market leaders in the Non-Nifty sectors (like Tyres, Bearings) or Top Challengers in the Nifty sectors (such as FMCG, Banks). The key parameters that we look at while selecting the companies here are low debt to operating cash flow and ROIC (Return on Invested Capital) greater than the Cost of Capital (CoC). The other part of the portfolio focuses on the Emerging Businesses. These are businesses in down cycles or where scale is yet to be achieved or where companies can fund growth without repeated dilutions. Many a times, earnings do not capture fair value of the businesses in down cycles or that are yet to achieve scale and hence popular ratios such as P/E ratio might not be the relevant metric to value the company. Thus, we believe that a better parameter for relative value evaluation could be the Enterprise Value (EV)/Sales ratio & Price/Book (P/B). We also filter stocks for Sustained improvement in RoE (Return on Equity) and RoCE (Return on Capital Employed) and those with Earnings Growth higher than Nifty. This segregation helps in easy management of risk & liquidity aspects of the portfolio.

OUTLOOK

The pandemic's second wave appears to have peaked and a

long "plateau" lies in front of us (similar to Jul-Sept 2020). The

pace of vaccination will be an important factor to re-start the

economic engine – which thankfully was in neutral rather than

switched off as the case last year.

For India, macros economic indicators - inflation and crude oil

remain the two key variables to track. From a macro point of

view, the debate of Cyclical vs Growth will rage till the time RBI

policy – which currently focuses entirely on Growth, pivots its

focus solely on inflation. It may be difficult to predict how long

this phase will last. For smart investors, observing/ keeping

track of key macro trends will need to become an integral part

of the investment process – domestic as well as global.

Markets at current elevated levels need the support of strong

earnings growth and continuation of the loose monetary policy

globally, especially in the US. Any perception of change to the

worse on both counts will make the markets nervous and

twitchy. Market corrections, as a result, will not be slow and

suffocating, they will be short and sharp. FY21-23 market move

may be more broad-based as compared to the FY17-20 phase.

The same may be necessitated across equity portfolios!

FUND FEATURES: (Data as on 30th June'21)

Category: Value

Monthly Avg AUM: Rs3,689.59 Crores

Inception Date: 7th March 2008

Fund Manager:

Mr. Anoop Bhaskar (w.e.f. 30/04/2016) & Mr. Daylynn Pinto (w.e.f. 20/10/2016)

Other Parameters:

Beta: 1.07

R Square: 0.97

Standard Deviation (Annualized): 30.45%

Benchmark: S&P BSE 400 MidSmallCap

TRI (w.e.f 11/11/2019)

Minimum Investment Amount: Rs5,000/- and any amount thereafter.

Exit Load:

• If redeemed/switched out within 365

days from the date of allotment:

➧ Upto 10% of investment:Nil,

➧ For remaining investment: 1% of

applicable NAV.

•If redeemed / switched out after 365

days from date of allotment: Nil. (w.e.f.

May 08, 2020)

SIP Frequency Monthly (Investor

may choose any day of the month

except 29th, 30th and 31st as the date

of instalment.)

Options Available: Growth, IDCW@

(Payout, Reinvestment and Sweep (from

Equity Schemes to Debt Schemes only))

| PLAN | IDCW@ RECORD DATE | ₹/UNIT | NAV |

| REGULAR | 20-Mar-20 | 0.73 | 12.8800 |

| 16-Feb-18 | 1.38 | 23.2025 | |

| 10-Mar-17 | 1.31 | 18.6235 | |

| DIRECT | 10-Mar-17 | 1.37 | 19.3894 |

| 21-Mar-16 | 1.50 | 16.3433 | |

| 16-Mar-15 | 2.00 | 20.8582 |

Face Value per Unit (in ₹) is 10

Income Distribution cum capital withdrawal is not guaranteed and past performance may or may not be sustained in future. Pursuant to payment of Income Distribution cum capital withdrawal, the NAV of the scheme would fall to the extent of payout and statutory levy (as applicable).

| PORTFOLIO | (30 June 2021) |

| Name of the Instrument | % of NAV |

| Equity and Equity related Instruments | 96.93% |

| Banks | 8.94% |

| ICICI Bank | 3.89% |

| State Bank of India | 1.91% |

| Axis Bank | 1.90% |

| RBL Bank | 1.24% |

| Consumer Durables | 8.40% |

| Voltas | 2.19% |

| Greenpanel Industries | 1.75% |

| Greenply Industries | 1.27% |

| Butterfly Gandhimathi Appliances | 1.17% |

| Crompton Greaves Consumer Electricals | 1.05% |

| Mayur Uniquoters | 0.97% |

| Cement & Cement Products | 8.09% |

| JK Cement | 2.67% |

| The Ramco Cements | 1.92% |

| Prism Johnson | 1.44% |

| Sagar Cements | 0.88% |

| Ambuja Cements | 0.80% |

| ACC | 0.38% |

| Software | 7.14% |

| Birlasoft | 2.14% |

| Persistent Systems | 1.81% |

| HCL Technologies | 1.65% |

| Zensar Technologies | 0.92% |

| KPIT Technologies | 0.63% |

| Auto Ancillaries | 7.00% |

| Minda Industries | 2.57% |

| Bosch | 1.77% |

| Wheels India | 1.32% |

| Tube Investments of India | 1.25% |

| Sterling Tools | 0.09% |

| Consumer Non Durables | 6.81% |

| Emami | 2.55% |

| Radico Khaitan | 2.34% |

| Tata Consumer Products | 1.92% |

| Industrial Products | 6.18% |

| Graphite India | 2.18% |

| Bharat Forge | 2.04% |

| Polycab India | 1.96% |

| Pharmaceuticals | 5.14% |

| Aurobindo Pharma | 1.81% |

| Cipla | 1.50% |

| IPCA Laboratories | 0.98% |

| Alembic Pharmaceuticals | 0.86% |

| Ferrous Metals | 4.70% |

| Jindal Steel & Power | 2.66% |

| Kirloskar Ferrous Industries | 1.28% |

| Maharashtra Seamless | 0.76% |

| Chemicals | 4.17% |

| Deepak Nitrite | 3.39% |

| SRF | 0.78% |

| Power | 3.93% |

| KEC International | 2.79% |

| Kalpataru Power Transmission | 1.14% |

| Gas | 3.27% |

| Gujarat Gas | 3.27% |

| Finance | 3.26% |

| Magma Fincorp | 1.65% |

| Mas Financial Services | 1.61% |

| Leisure Services | 2.89% |

| The Indian Hotels Company | 1.86% |

| EIH | 1.03% |

| Insurance | 2.56% |

| SBI Life Insurance Company | 1.30% |

| ICICI Lombard General Insurance Company | 1.26% |

| Construction Project | 2.54% |

| NCC | 2.54% |

| Textile Products | 2.23% |

| K.P.R. Mill | 1.66% |

| Dollar Industries | 0.57% |

| Textiles - Cotton | 1.90% |

| Vardhman Textiles | 1.63% |

| Nitin Spinners | 0.27% |

| Transportation | 1.82% |

| VRL Logistics | 1.82% |

| Petroleum Products | 1.44% |

| Bharat Petroleum Corporation | 1.44% |

| Industrial Capital Goods | 1.41% |

| CG Power and Industrial Solutions | 1.31% |

| Skipper | 0.10% |

| Retailing | 1.35% |

| V-Mart Retail | 1.35% |

| Auto | 1.04% |

| Tata Motors | 1.04% |

| Capital Markets | 0.72% |

| ICICI Securities | 0.72% |

| Net Cash and Cash Equivalent | 3.07% |

| Grand Total | 100.00% |

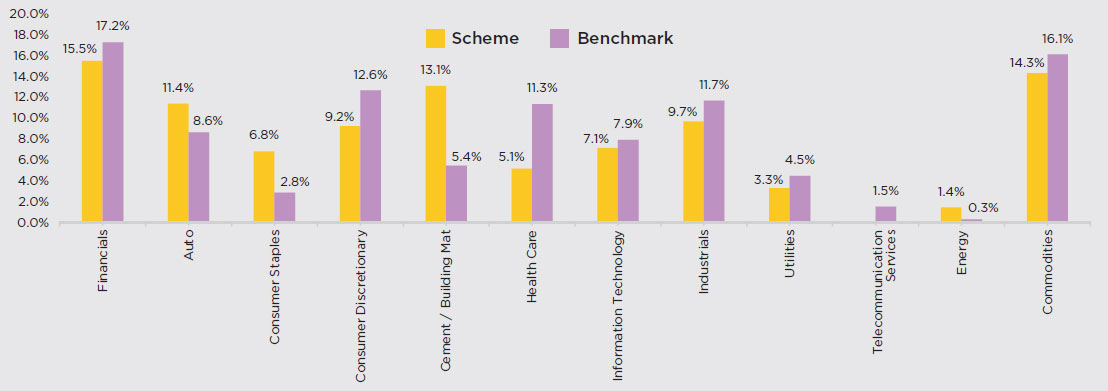

SECTOR ALLOCATION

RISKOMETER

This product is suitable for investors who are seeking*:

• To create wealth over long term

• Investment predominantly in equity and equity related instruments

following a value investment strategy

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

The above mentioned is the current strategy of the Fund Manager. However, asset allocation and investment strategy shall be within broad parameters of Scheme Information Document.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |