IDFC BANKING & PSU DEBT FUND

An open ended debt scheme predominantly investing in debt

instruments of banks, Public Sector Undertakings, Public Financial

Institutions and Municipal Bonds.

IDFC BANKING & PSU DEBT FUND

An open ended debt scheme predominantly investing in debt

instruments of banks, Public Sector Undertakings, Public Financial

Institutions and Municipal Bonds.

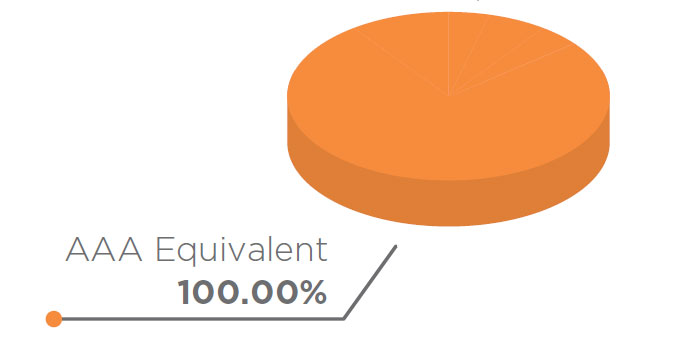

• A portfolio that emphasizes on high quality

instruments. currently 100% AAA and equivalent

instruments.

• By investing in one single fund you get to diversify your

allocation into multiple high quality instruments issued

by banks, PSUs (Public Sector Undertakings), PFIs

(Public Financial Institutions) and Municipal Bonds.

• Ideal to form part of ‘Core’ Bucket – due to its high

quality and low to moderate duration profile

FUND FEATURES: (Data as on 30th June'21)

Category: Banking and PSU

Monthly Avg AUM: Rs18,343.52 Crores

Inception Date: 7th March 2013

Fund Manager: Mr. Anurag Mittal

(w.e.f. 15th May 2017)

Standard Deviation (Annualized): 1.63%

Modified duration 1.56 years

Average Maturity: 1.74 years

Macaulay Duration: 1.63 years

Yield to Maturity: 4.68%

Benchmark: NIFTY Banking & PSU

Debt Index (w.e.f 11/11/2019)

Minimum Investment Amount: Rs5,000/- and any amount thereafter

Exit Load: Nil (w.e.f. 12th June 2017)

Options Available : Growth, IDCW@

- Daily, Fortnightly, Monthly

(Reinvestment), Quarterly (Payout),

Annual (Payout) & Periodic (Payout &

Reinvestment)

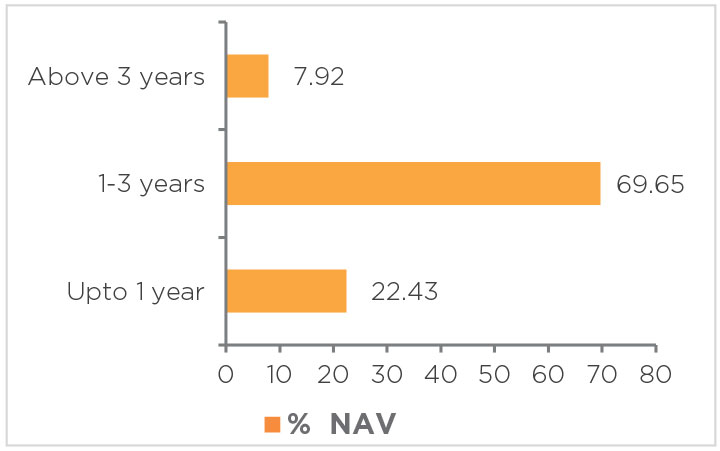

Maturity Bucket:

@Income Distribution cum capital withdrawal

| PORTFOLIO | (30 June 2021) |

| Name | Rating | Total (%) |

| Corporate Bond | 79.83% | |

| NABARD | AAA | 11.33% |

| Power Finance Corporation | AAA | 7.63% |

| HDFC | AAA | 5.87% |

| Indian Railway Finance Corporation | AAA | 5.83% |

| REC | AAA | 5.63% |

| Axis Bank | AAA | 5.58% |

| Hindustan Petroleum Corporation | AAA | 5.20% |

| National Highways Auth of Ind | AAA | 5.01% |

| LIC Housing Finance | AAA | 4.57% |

| Small Industries Dev Bank of India | AAA | 4.24% |

| National Housing Bank | AAA | 3.62% |

| ICICI Bank | AAA | 2.89% |

| Export Import Bank of India | AAA | 2.75% |

| Reliance Industries | AAA | 2.30% |

| Power Grid Corporation of India | AAA | 2.11% |

| Housing & Urban Development Corporation | AAA | 1.69% |

| NTPC | AAA | 1.35% |

| NHPC | AAA | 0.95% |

| Larsen & Toubro | AAA | 0.85% |

| Bajaj Finance | AAA | 0.28% |

| Indian Oil Corporation | AAA | 0.14% |

| Tata Sons Private | AAA | 0.01% |

| Government Bond | 11.73% | |

| 7.32% - 2024 G-Sec | SOV | 3.23% |

| 7.16% - 2023 G-Sec | SOV | 3.11% |

| 7.37% - 2023 G-Sec | SOV | 3.09% |

| 5.22% - 2025 G-Sec | SOV | 1.67% |

| 6.18% - 2024 G-Sec | SOV | 0.31% |

| 6.84% - 2022 G-Sec | SOV | 0.20% |

| 8.13% - 2022 G-Sec | SOV | 0.11% |

| Certificate of Deposit | 3.50% | |

| Axis Bank | A1+ | 2.75% |

| Export Import Bank of India | A1+ | 0.75% |

| Commercial Paper | 0.70% | |

| Export Import Bank of India | A1+ | 0.70% |

| State Government Bond | 0.69% | |

| 9.25% Haryana SDL - 2023 | SOV | 0.30% |

| 5.41% Andhra Pradesh SDL - 2024 | SOV | 0.14% |

| 5.68% Maharashtra SDL - 2024 | SOV | 0.08% |

| 7.93% Chattisgarh SDL - 2024 | SOV | 0.06% |

| 8.62% Maharashtra SDL - 2023 | SOV | 0.06% |

| 7.77% Gujarat SDL - 2023 | SOV | 0.03% |

| 5.93% ODISHA SDL - 2022 | SOV | 0.02% |

| 8.48% Tamilnadu SDL - 2023 | SOV | 0.01% |

| 8.10% Tamil Nadu SDL - 2023 | SOV | 0.003% |

| Floating Rate Note | 0.16% | |

| Kotak Mahindra Bank | A1+ | 0.16% |

| Zero Coupon Bond | 0.02% | |

| LIC Housing Finance | AAA | 0.02% |

| Net Cash and Cash Equivalent | 3.37% | |

| Grand Total | 100.00% |

ASSET QUALITY

RISKOMETER

This product is suitable for investors who are seeking*:

• To generate optimal returns over short to medium term

• Investments predominantly in debt & money market instruments

issued by PSU, Banks & PFI

*Investors should consult their financial advisors if in doubt

about whether the product is suitable for them.

$$For details please refer Notice ( https://www.idfcmf.com/uploads/090520171306No-18-Change-in-Scheme-features-of-IDFC-Banking-Debt-Fund.pdf )

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |