IDFC GOVERNMENT SECURITIES FUND-INVESTMENT PLAN

An open ended debt scheme investing in government securities across maturities

IDFC GOVERNMENT SECURITIES FUND-INVESTMENT PLAN

An open ended debt scheme investing in government securities across maturities

A dedicated gilt fund with an objective to generate optimal returns with high liquidity by investing in Government Securities.

OUTLOOK

• From an investor’s standpoint, it is quite important in our

view that portfolio yields be looked at somewhat

dynamically.

• Thus after a 3 year bull run in bonds if the portfolio manager

is creating some hedges and flexibilities that in turn are

showing up as reduction in yield, then this may even be

looked at as a source of comfort for investors (please refer

to our note ‘Hedging fixed income in volatile times’, dated

22nd June’21 –https://idfcmf.com/article/4984 for further

details).

• Similarly, if corporate / credit spreads have narrowed to

unsustainable levels in some cases and the manager hence

decides to move to more quality assets, this could be a

move to protect against future risks to spread expansion

even as it entails some dilution in portfolio yields of the

current portfolio.

• Thus a static analysis of portfolio yields and choosing the

highest of these for every category of funds may not

optimize risk versus reward, especially at cycle turning

points.

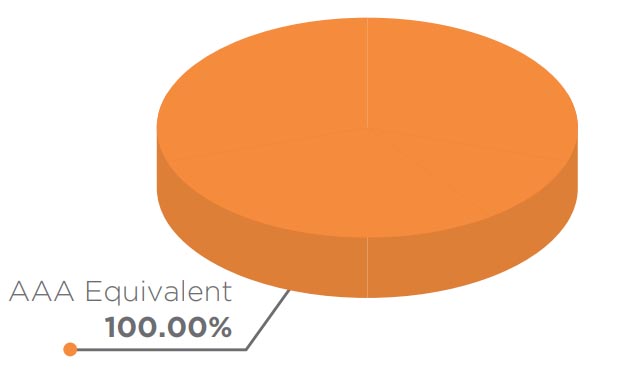

ASSET QUALITY

FUND FEATURES: (Data as on 30th June'21)

Category: Gilt

Monthly Avg AUM: Rs1,883.26 Crores

Inception Date: 9th March 2002

Fund Manager:

Mr. Suyash

Choudhary (Since 15th October 2010)

Standard Deviation (Annualized): 4.40%

Modified duration: 2.06 years

Average Maturity: 2.47 years

Macaulay Duration: 2.12 years

Yield to Maturity: 4.55%

Benchmark: CRISIL Dynamic

Gilt Index (w.e.f 01st February, 2019)

Minimum Investment Amount: Rs5,000/- and any amount thereafter.

Exit Load: Nil (w.e.f. 15th July 2011)

Options Available: Growth, IDCW@

- Quarterly, Half Yearly, Annual,

Regular & Periodic

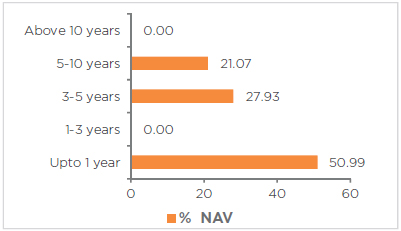

Maturity Bucket:

@Income Distribution cum capital withdrawal

| PORTFOLIO | (30 June 2021) |

| Name | Rating | Total (%) |

| Government Bond | 49.01% | |

| 5.63% - 2026 G-Sec | SOV | 24.14% |

| 6.97% - 2026 G-Sec | SOV | 20.96% |

| 7.59% - 2026 G-Sec | SOV | 3.79% |

| 7.26% - 2029 G-Sec | SOV | 0.11% |

| 7.17% - 2028 G-Sec | SOV | 0.003% |

| Net Cash and Cash Equivalent | td> | 50.99% |

| Grand Total | 100.00% |

RISKOMETER

This product is suitable for investors who are seeking*:

• To generate long term optimal returns.

• Investments in Government Securities across maturities.

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

Standard Deviation calculated on the basis of 1 year history of monthly data

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |