IDFC ULTRA SHORT TERM FUND

An open-ended ultra-short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3 to 6 months

IDFC ULTRA SHORT TERM FUND

An open-ended ultra-short term debt scheme investing in instruments such that the Macaulay duration of the portfolio is between 3 to 6 months

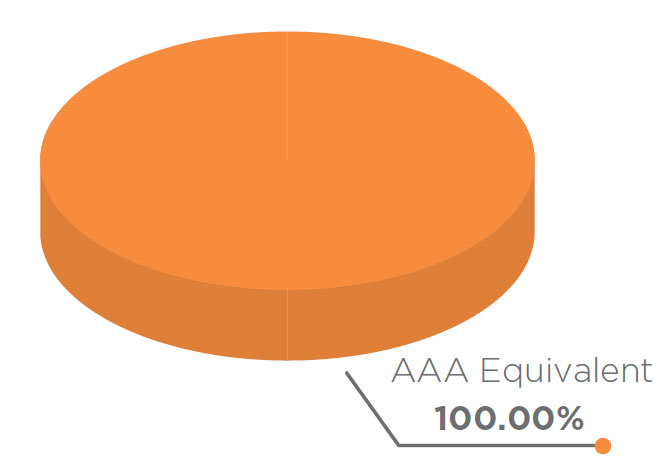

The Fund aims to invest in high quality debt and

money market instruments with macaulay duration of

3 to 6 months and seeks to generate stable returns

with a low risk strategy

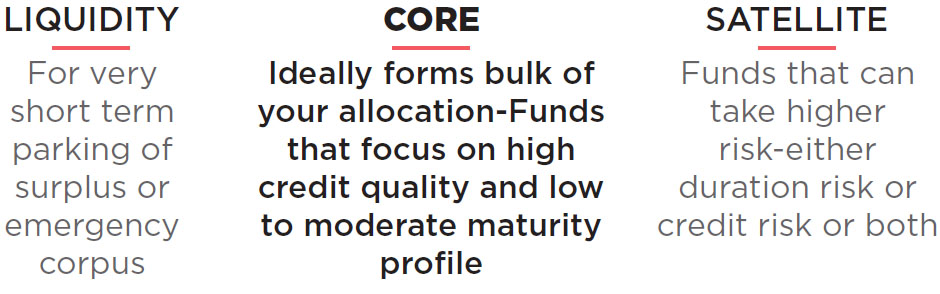

• Suitable for near term goals - this fund is

recommended for a minimum investment horizon of

3 months

• Ideal to form part of ‘Core’ Bucket – due to its high

quality and low duration profile

ASSET QUALITY

FUND FEATURES: (Data as on 30th June'21)

Category: Ultra Short Duration

Monthly Avg AUM: Rs5,869.06 Crores

Inception Date: 18th July 2018

Fund Manager:

Mr. Harshal Joshi (w.e.f. 18th July 2018)

Modified duration 98 days

Average Maturity: 109 days

Macaulay Duration: 101 days

Yield to Maturity: 3.59%

Benchmark: NIFTY Ultra Short

Duration Debt Index (w.e.f 01st February, 2019)

Minimum Investment Amount: Rs100/- and any amount thereafter

Exit Load: Nil

Options Available: Growth &

IDCW@ Option - Daily (Reinvestment),

Weekly (Reinvestment), Monthly ,

Quarterly & Periodic (each with

Reinvestment, Payout and Sweep

facility).

@Income Distribution cum capital withdrawal

| PORTFOLIO | (30 June 2021) |

| Name | Rating | Total (%) |

| Commercial Paper | 25.72% | |

| Reliance Industries | A1+ | 10.91% |

| Indian Oil Corporation | A1+ | 3.65% |

| LIC Housing Finance | A1+ | 3.64% |

| NABARD | A1+ | 3.63% |

| Kotak Mahindra Investments | A1+ | 2.71% |

| Kotak Mahindra Prime | A1+ | 0.91% |

| Export Import Bank of India | A1+ | 0.27% |

| Treasury Bill | 25.02% | |

| 91 Days Tbill - 2021 | SOV | 18.26% |

| 182 Days Tbill - 2021 | SOV | 6.75% |

| Corporate Bond | 21.58% | |

| HDFC | AAA | 4.71% |

| LIC Housing Finance | AAA | 3.95% |

| HDB Financial Services | AAA | 3.78% |

| Power Finance Corporation | AAA | 2.87% |

| Small Industries Dev Bank of India | AAA | 2.85% |

| NABARD | AAA | 2.12% |

| REC | AAA | 1.12% |

| Indian Railway Finance Corporation | AAA | 0.10% |

| Reliance Industries | AAA | 0.09% |

| Certificate of Deposit | 7.26% | |

| Axis Bank | A1+ | 7.26% |

| State Government Bond | 5.38% | |

| 6.92% MAHARASTRA SDL - 2022 | SOV | 2.04% |

| 8.38% Karnataka SDL - 2022 | SOV | 1.63% |

| 8.31% Karnataka SDL - 2022 | SOV | 1.06% |

| 7.9% CHHATISGARH SDL - 2021 | SOV | 0.28% |

| 8.84% Gujrat SDL - 2022 | SOV | 0.10% |

| 8.90% Andhra pradesh SDL - 2022 | SOV | 0.10% |

| 8.79% Maharashtra SDL - 2021 | SOV | 0.09% |

| 7.03% Gujarat SDL - 2021 | SOV | 0.09% |

| Floating Rate Note | 1.83% | |

| Axis Bank | A1+ | 1.83% |

| Zero Coupon Bond | 1.77% | |

| LIC Housing Finance | AAA | 1.77% |

| Net Cash and Cash Equivalent | 11.45% | |

| Grand Total | 100.00% | |

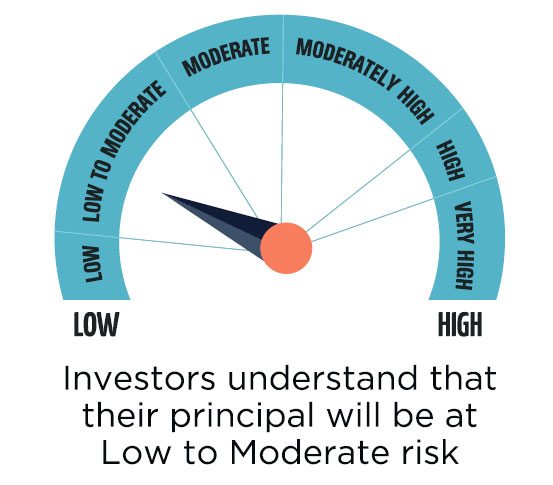

RISKOMETER

This product is suitable for investors who are seeking*:

• To generate returns over short-term investment horizon with a low risk

strategy

• To invest in debt and money market instruments

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |