IDFC EMERGING BUSINESSES FUND

IDFC EMERGING BUSINESSES FUND

(Small Cap Fund – An open ended equity scheme

predominantly investing in small cap stocks)

• Fund focuses on building a diversified portfolio

within the small cap segment.

• Portfolio will contain buy and hold strategies as well

as opportunistic picks in the cyclical space.

• Fund may also look to participate in new businesses

via IPOs.

FUND PHILOSOPHY*

The fund aims to identify and invest in companies with steady

growth prospects, operating in industries with a stable growth

visibility over the medium term – 2-4 years. The fund would be

willing to pay higher valuation for companies with distinct

segment leadership advantages and/or for companies operating

in segments which are witnessing a boost of growth due to

change in industry dynamics; regulatory changes / geographical

shifts. While not eschewing completely, the fund aims to limit

exposure to “deep” cyclicals and focus more on companies and

sectors with secular growth outlook. Hence, the valuation metrics

of the fund – P/E; EV/EBIDTA; EV/Sales may appear to be more

expensive than the benchmark.

Consumer facing rather than B to B is another focus area of the

fund. The fund aims to ensure participation in non-small caps as a

measure of higher liquidity as well addressability for investing in

sectors where size brings noticeable advantage – BFSI, for

example. The fund aims to hold cash levels of upto 10% across

time periods, both as a measure of liquidity as well as to

capitalize on opportunistic investing. Lastly, rather than try to

outperform the benchmark on the upside, the fund would aim to

conserve capital by limiting downside during periods of

drawdowns, a dominant (and painful) characteristic of small cap

investing.

OUTLOOK

Three key drivers of Equity markets are 1) Earnings 2) Interest

Rates and 3) Valuations.

Earnings - For the first time since the 2008 GFC, India has seen 4

consecutive quarters where BSE200 2-year Forward EPS has

been upgraded. Sustained momentum in earnings resulting in a

cycle of earnings upgrades can help drives markets higher.

Interest Rates - Interest Rates, both in India and globally are

trending upwards on account of higher inflation and faster than

expected economic recovery. Higher interest rates are generally

negative for Valuations.

Valuation - Indian markets have significantly outperformed global

markets since the pandemic bottom. The scope for valuation

rerating driven market move is limited.

FUND FEATURES: (Data as on 31st October'21)

Category: Small Cap Fund

Monthly Avg AUM: Rs 1,466.33 Crores

Inception Date: 25th February 2020

Fund Manager: Mr. Anoop Bhaskar

Benchmark: S&P BSE 250 SmallCap-TRI

Exit Load:

1% if redeemed/switched out within 1

year from the date of allotment

Minimum Investment Amount: Rs100 and in

multiples of Rs1 thereafter

SIP Frequency: Monthly

SIP Dates (Monthly): Investor may

choose any day of the month except

29th, 30th and 31st as the date of

instalment.

Options Available: The Scheme offer

IDCW@ Option & Growth Option.

IDCW@ Option under each Plan further

offers of choice of Payout & Sweep

facilities.

@Income Distribution cum capital withdrawal

| PORTFOLIO | (31 October 2021) |

| Name | % of NAV |

| Equity and Equity related Instruments | 96.70% |

| Consumer Non Durables | 14.12% |

| Radico Khaitan | 5.33% |

| Balrampur Chini Mills | 2.00% |

| DCM Shriram | 1.29% |

| Heritage Foods | 1.20% |

| United Spirits | 1.11% |

| Godfrey Phillips India | 0.93% |

| DFM Foods | 0.91% |

| Emami | 0.74% |

| Jyothy Labs | 0.61% |

| Industrial Products | 11.36% |

| Shaily Engineering Plastics | 3.57% |

| Carborundum Universal | 2.04% |

| Polycab India | 1.81% |

| Graphite India | 1.49% |

| EPL | 0.97% |

| Kirloskar Brothers | 0.83% |

| Huhtamaki India | 0.64% |

| Software | 10.65% |

| Birlasoft | 3.09% |

| Zensar Technologies | 2.29% |

| Cyient | 2.19% |

| eClerx Services | 1.90% |

| Mastek | 1.18% |

| Auto Ancillaries | 8.94% |

| Wheels India | 2.36% |

| GNA Axles | 1.85% |

| Alicon Castalloy | 1.81% |

| Jamna Auto Industries | 1.54% |

| Automotive Axles | 1.39% |

| Chemicals | 6.74% |

| NOCIL | 3.23% |

| Navin Fluorine International | 1.50% |

| Chemplast Sanmar | 1.42% |

| Chemcon Speciality Chemicals | 0.58% |

| Consumer Durables | 5.90% |

| Kajaria Ceramics | 2.73% |

| Mayur Uniquoters | 1.48% |

| Cera Sanitaryware | 1.07% |

| Greenply Industries | 0.62% |

| Auto | 5.03% |

| Ashok Leyland | 2.11% |

| Tata Motors | 1.58% |

| Maruti Suzuki India | 1.33% |

| Leisure Services | 4.33% |

| Westlife Development | 2.19% |

| EIH | 1.50% |

| Burger King India | 0.64% |

| Capital Markets | 3.78% |

| Multi Commodity Exchange of India | 2.12% |

| UTI Asset Management Company | 1.67% |

| Healthcare Services | 3.76% |

| Narayana Hrudayalaya | 1.80% |

| Krsnaa Diagnostics | 1.08% |

| Krishna Institute of Medical Sciences | 0.89% |

| Pharmaceuticals | 3.68% |

| Gland Pharma | 1.38% |

| FDC | 1.27% |

| Laurus Labs | 1.03% |

| Cement & Cement Products | 3.27% |

| Sagar Cements | 1.89% |

| JK Lakshmi Cement | 1.38% |

| Pesticides | 2.65% |

| Heranba Industries | 1.35% |

| Rallis India | 1.29% |

| Banks | 2.36% |

| State Bank of India | 1.93% |

| Suryoday Small Finance Bank | 0.43% |

| Commercial Services | 2.26% |

| TeamLease Services | 2.26% |

| Petroleum Products | 1.59% |

| Gulf Oil Lubricants India | 1.59% |

| Power | 1.48% |

| Kalpataru Power Transmission | 1.48% |

| Retailing | 1.42% |

| V-Mart Retail | 1.42% |

| Finance | 1.23% |

| JM Financial | 0.58% |

| Poonawalla Fincorp | 0.38% |

| SBI Cards and Payment Services | 0.27% |

| Telecom - Services | 0.94% |

| Bharti Airtel | 0.94% |

| Textiles - Cotton | 0.73% |

| Nitin Spinners | 0.73% |

| Insurance | 0.48% |

| SBI Life Insurance Company | 0.48% |

| Net Cash and Cash Equivalent | 3.30% |

| Grand Total | 100.00% |

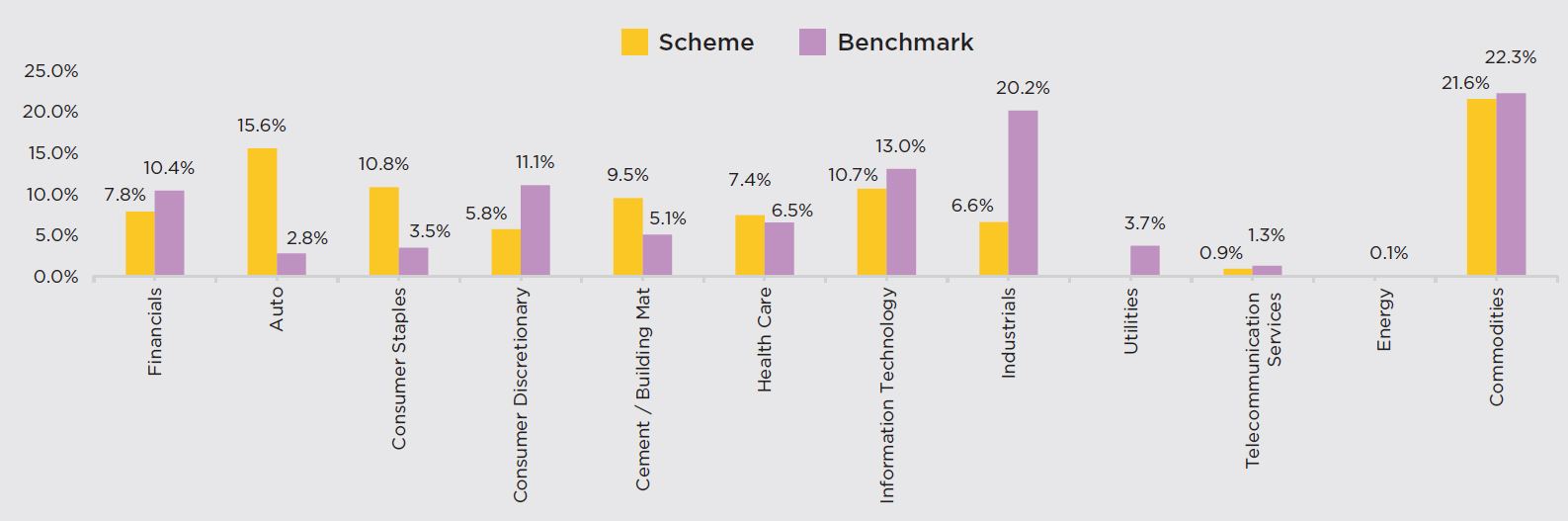

SECTOR ALLOCATION

RISKOMETER

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To create wealth over long term

• Investment in equity and equity related instruments of

Small cap companies.

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

shall be within broad parameters of Scheme Information Document.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |