IDFC Flexi Cap Fund^

IDFC Flexi Cap Fund^

(previously known as IDFC Multi Cap Fund)

IDFC Flexi Cap Fund – An open ended

equity scheme investing across large

cap, mid cap, small cap stocks.

FUND PHILOSOPHY*

The fund will invest in equity and equity related instruments

which is diversified across market capitalization viz. Large Cap

companies, Mid Cap companies and Small Cap companies spread

across sectors.

The Fund Manager will generally invest in a few selected sectors,

which in the opinion of the fund manager have potential to grow.

OUTLOOK

Three key drivers of Equity markets are 1) Earnings 2)

Interest Rates and 3) Valuations.

Earnings - For the first time since the 2008 GFC, India

has seen 4 consecutive quarters where BSE200 2-year

Forward EPS has been upgraded. Sustained

momentum in earnings resulting in a cycle of earnings

upgrades can help drives markets higher.

Interest Rates - Interest Rates, both in India and

globally are trending upwards on account of higher

inflation and faster than expected economic recovery.

Higher interest rates are generally negative for

Valuations.

Valuation - Indian markets have significantly

outperformed global markets since the pandemic

bottom. The scope for valuation rerating driven market

move is limited.

FUND FEATURES: (Data as on 31st October'21)

Category: Flexi-cap

Monthly Avg AUM: Rs6,109.69 Crores

Inception Date: 28th September

2005

Fund Manager:

Mr. Anoop Bhaskar (w.e.f.

30th April 2016) & Mr. Sachin Relekar

(w.e.f. 8th Dec, 2020)

Benchmark: S&P BSE 500 TRI

Minimum Investment Amount: Rs10,000/-

and any amount thereafter. (Units of IDFC

Flexi Cap Fund, shall be available for lump

sum subscription w.e.f. May 07, 2018)

Exit Load:

• If redeemed/switched out within 365

days from the date of allotment:

➧ Upto 10% of investment:Nil,

➧ For remaining investment: 1% of

applicable NAV.

• If redeemed / switched out after 365

days from date of allotment: Nil. (w.e.f.

May 08, 2020)

SIP Frequency Monthly (Investor may

choose any day of the month except 29th,

30th and 31st as the date of instalment.)

Minimum SIP Investment Amount: Rs 100/- (Minimum 6 instalments) (w.e.f. 2nd

May 2018)

Options Available: Growth, IDCW@

(Payout, Reinvestment and Sweep (from

Equity Schemes to Debt Schemes only))

Other Parameters:

Beta: 0.89

R Square: 0.92

Standard Deviation (Annualized): 20.20%

| PLAN | IDCW@ RECORD DATE | ₹/UNIT | NAV |

| REGULAR | 29-Jun-21 | 1.96 | 39.4800 |

| 20-Mar-20 | 1.39 | 25.5900 | |

| 01-Mar-19 | 1.67 | 32.2300 | |

| DIRECT | 29-Jun-21 | 2.07 | 41.8100 |

| 20-Mar-20 | 1.46 | 26.8600 | |

| 01-Mar-19 | 1.74 | 33.5900 |

Income Distribution cum capital withdrawal is not guaranteed and past performance may or may not be sustained in future. Pursuant to payment of Income Distribution cum capital withdrawal, the NAV of the scheme would fall to the extent of payout and statutory levy (as applicable). @Income Distribution cum capital withdrawal

| PORTFOLIO | (31 October 2021) |

| Name of the Instrument | Ratings | % of NAV |

| Equity and Equity related Instruments | 98.11% | |

| Banks | 23.40% | |

| ICICI Bank | 9.05% | |

| HDFC Bank | 6.37% | |

| State Bank of India | 4.02% | |

| Axis Bank | 2.07% | |

| Kotak Mahindra Bank | 1.89% | |

| Software | 14.52% | |

| Infosys | 8.24% | |

| Tata Consultancy Services | 3.13% | |

| MphasiS | 2.07% | |

| Wipro | 1.08% | |

| Consumer Durables | 8.61% | |

| Voltas | 3.10% | |

| Bata India | 2.44% | |

| Titan Company | 1.97% | |

| Crompton Greaves Consumer Electricals | 1.10% | |

| Consumer Non Durables | 7.52% | |

| Asian Paints | 2.06% | |

| 3M India | 2.03% | |

| Hindustan Unilever | 1.38% | |

| Nestle India | 1.07% | |

| S H Kelkar and Company | 0.99% | |

| Chemicals | 4.85% | |

| Atul | 3.23% | |

| Fine Organic Industries | 1.62% | |

| Industrial Products | 4.48% | |

| Supreme Industries | 1.88% | |

| Kirloskar Pneumatic Company | 1.29% | |

| Schaeffler India | 1.19% | |

| Carborundum Universal | 0.10% | |

| Disa India | 0.02% | |

| Auto | 4.18% | |

| Tata Motors | 2.20% | |

| Mahindra & Mahindra | 1.98% | |

| Cement & Cement Products | 4.12% | |

| UltraTech Cement | 4.12% | |

| Finance | 3.37% | |

| Bajaj Finance | 2.88% | |

| Mas Financial Services | 0.48% | |

| Retailing | 3.27% | |

| Avenue Supermarts | 2.69% | |

| Zomato | 0.58% | |

| Pharmaceuticals | 3.20% | |

| Divi's Laboratories | 1.99% | |

| Cipla | 1.21% | |

| Auto Ancillaries | 2.87% | |

| Minda Industries | 2.87% | |

| Construction Project | 2.11% | |

| Larsen & Toubro | 2.11% | |

| Capital Markets | 2.01% | |

| Multi Commodity Exchange of India | 2.01% | |

| Telecom - Services | 1.88% | |

| Bharti Airtel | 1.88% | |

| Ferrous Metals | 1.80% | |

| APL Apollo Tubes | 1.80% | |

| Leisure Services | 1.63% | |

| Jubilant Foodworks | 1.63% | |

| Insurance | 1.59% | |

| HDFC Life Insurance Company | 1.59% | |

| Textiles - Cotton | 1.43% | |

| Vardhman Textiles | 1.43% | |

| Non - Ferrous Metals | 1.14% | |

| Hindalco Industries | 1.14% | |

| Construction | 0.13% | |

| Poddar Housing and Development | 0.13% | |

| Corporate Bond | 0.01% | |

| Britannia Industries | AAA | 0.01% |

| Net Cash and Cash Equivalent | 1.88% | |

| Grand Total | 100.00% |

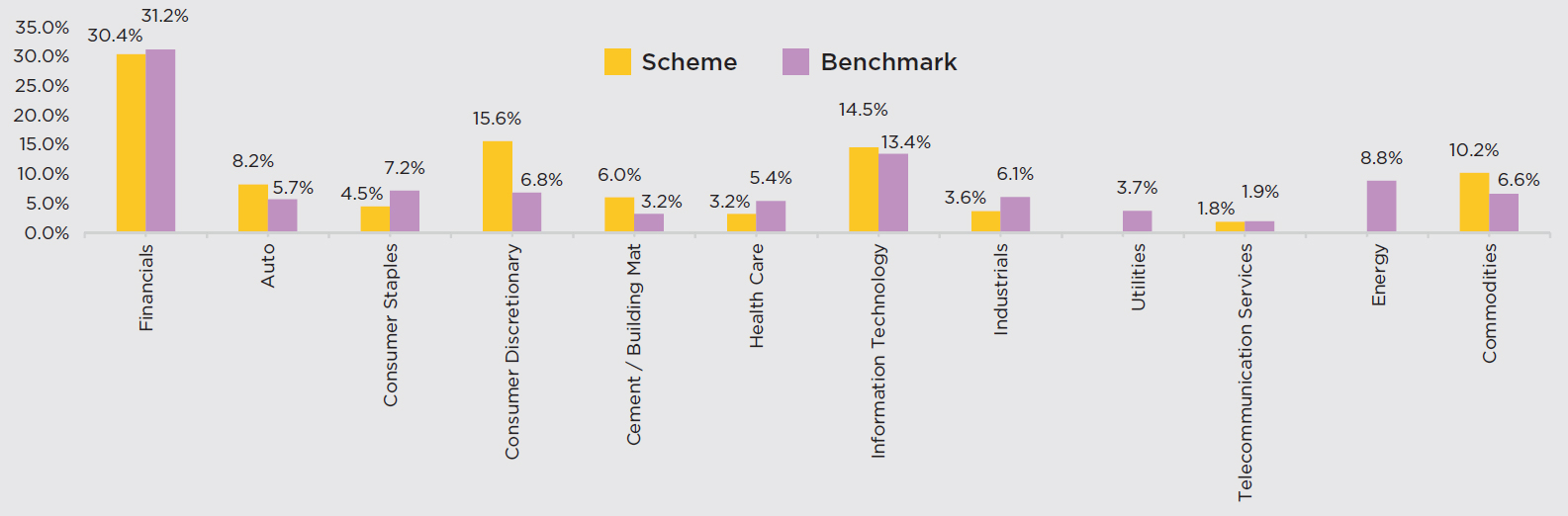

SECTOR ALLOCATION

RISKOMETER

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To create wealth over long term

• Investment predominantly in equity and equity related instruments

across market capitalisation.

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

The above mentioned is the current strategy of the Fund Manager. However, asset allocation and investment strategy shall be within broad parameters of Scheme Information Document.

The scheme has repositioned from IDFC Multi Cap Fund to IDFC Flexi Cap Fund with effect from February 9, 2021.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |