IDFC DYNAMIC BOND FUND

IDFC DYNAMIC BOND FUND

An open ended dynamic debt scheme investing across duration

The fund is positioned in the dynamic bond fund

category to take exposure across the curve

depending upon the fund manager’s underlying

interest rate view where we employ the majority of

the portfolio. It is a wide structure and conceptually

can go anywhere on the curve.

OUTLOOK

Markets across many such geographies have brought

forward their expectations for interest rate hikes, as

unprecedented supply side shortages (including energy

shocks) meet equally unprecedented fiscal stimuli in

some of these economies, thereby challenging the

‘transitory’ narrative on inflation.

Front end rates, which are most susceptible to interest

rate hike expectations, had risen sharply in many

geographies as a result, more than doubling in some

cases over this relatively brief span. Subsequently, many

developed market central banks stepped in to push

against these rate hike expectations, which led to some

cooling off in developed market yields.

India was also influenced with these global goings on

with yields, particularly on swaps, first rising and

subsequently falling in line with these developments.

In our view, bar-belling may remain the best way to

navigate these times. For longer horizons or more

aggressive profiles, the view can be expressed as just a

plain long position in intermediate maturity 4 – 6 years.

ASSET QUALITY

FUND FEATURES: (Data as on 31st October'21)

Category: Dynamic Bond

Monthly Avg AUM: Rs3,843.72 Crores

Inception Date: 25th June 2002

Fund Manager:

Mr. Suyash

Choudhary (Since 15th October 2010)

Standard Deviation (Annualized): 2.85%

Modified duration: 3.87 years

Average Maturity: 4.45 years

Macaulay Duration: 3.98 years

Yield to Maturity: 5.84%

Benchmark: CRISIL Composite Bond

Fund Index

Minimum Investment Amount: Rs5,000/- and any amount thereafter.

Exit Load: Nil (w.e.f. 17th October

2016)

Options Available: Growth, IDCW@

- Periodic, Quarterly, Half Yearly, Annual

and Regular frequency (each with

Reinvestment, Payout and Sweep

facility)

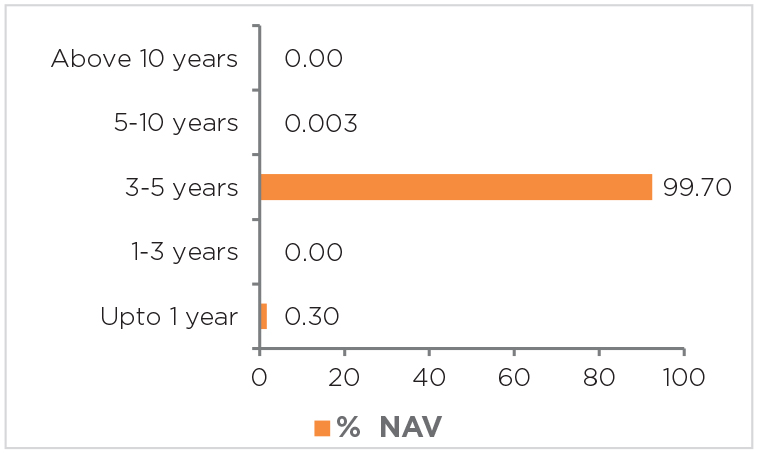

Maturity Bucket:

@Income Distribution cum capital withdrawal

| PORTFOLIO | (31 October 2021) |

| Name | Rating | Total (%) |

| Government Bond | 99.70% | |

| 5.63% - 2026 G-Sec | SOV | 99.69% |

| 8.20% - 2025 G-Sec | SOV | 0.003% |

| 7.17% - 2028 G-Sec | SOV | 0.003% |

| Net Cash and Cash Equivalent | 0.30% | |

| Grand Total | 100.00% |

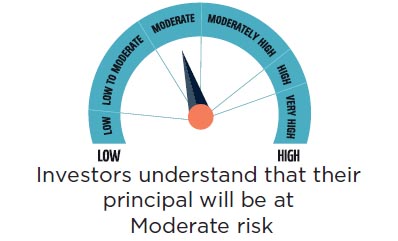

RISKOMETER

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To generate long term optimal returns by active management

• Investments in money market & debt instruments including

G-Sec across duration

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

Standard Deviation calculated on the basis of 1 year history of monthly data

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |