IDFC GOVERNMENT SECURITIES FUND - CONSTANT MATURITY PLAN

An open ended debt scheme investing in government securities having a constant maturity of 10 years

IDFC GOVERNMENT SECURITIES FUND - CONSTANT MATURITY PLAN

An open ended debt scheme investing in government securities having a constant maturity of 10 years

The fund is a mix of government bonds, state development loans (SDLs), treasury bills and/or cash management bills. The fund will predominantly have an average maturity of around 10 years.

OUTLOOK

Markets across many such geographies have brought

forward their expectations for interest rate hikes, as

unprecedented supply side shortages (including

energy shocks) meet equally unprecedented fiscal

stimuli in some of these economies, thereby

challenging the ‘transitory’ narrative on inflation.

Front end rates, which are most susceptible to interest

rate hike expectations, had risen sharply in many

geographies as a result, more than doubling in some

cases over this relatively brief span. Subsequently,

many developed market central banks stepped in to

push against these rate hike expectations, which led to

some cooling off in developed market yields.

India was also influenced with these global goings on

with yields, particularly on swaps, first rising and

subsequently falling in line with these developments.

In our view, bar-belling may remain the best way to

navigate these times. For longer horizons or more

aggressive profiles, the view can be expressed as just

a plain long position in intermediate maturity 4 – 6

years.

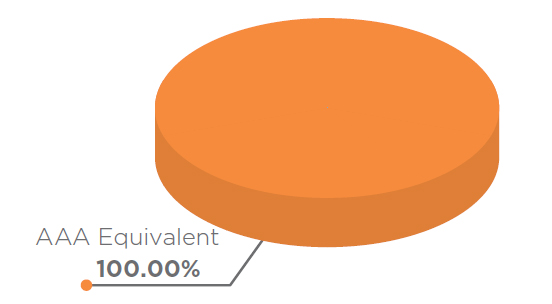

ASSET QUALITY

FUND FEATURES: (Data as on 31st October'21)

Category: Gilt Fund with 10 year

constant duration

Monthly Avg AUM: Rs266.27 Crores

Inception Date: 9th March 2002

Fund Manager:

Mr. Harshal Joshi

(w.e.f. 15th May 2017)

Standard Deviation (Annualized): 3.57%

Modified duration: 6.74 years

Average Maturity: 9.18 years

Macaulay Duration: 6.95 years

Yield to Maturity: 6.39%

Benchmark: CRISIL 10 year Gilt Index

(w.e.f. 28th May 2018)

Minimum Investment Amount: Rs5,000/- and any amount thereafter.

Exit Load: Nil

Options Available: Growth & IDCW@ Option

- Quarterly, Half yearly, Annual, Regular and

Periodic (each with payout, reinvestment

and sweep facility).

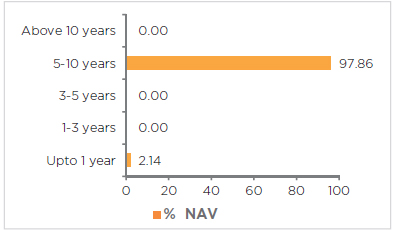

Maturity Bucket:

@Income Distribution cum capital withdrawal

| PORTFOLIO | (31 October 2021) |

| Name | Rating | Total (%) |

| Government Bond | 97.86% | |

| 6.1% - 2031 G-Sec | SOV | 85.62% |

| 7.17% - 2028 G-Sec | SOV | 6.68% |

| 8.24% - 2027 G-Sec | SOV | 3.00% |

| 6.79% - 2027 G-Sec | SOV | 2.56% |

| Net Cash and Cash Equivalent | 2.14% | |

| Grand Total | 100.00% |

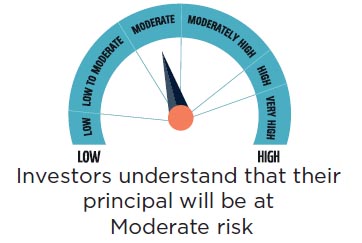

RISKOMETER

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To generate optimal returns over long term

• Investments in Government Securities such that the average

maturity of the portfolio is around 10 years

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

Gsec/SDL yields have been annualized wherever applicable

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |