IDFC Multi Cap Fund

IDFC Multi Cap Fund

An open-ended equity scheme investing across large cap,

mid cap, small cap stocks

The Fund seeks to generate long term

capital appreciation by investing in a

diversified portfolio of equity & equity

related instruments across large cap, mid

cap, small cap stocks.

FUND PHILOSOPHY*

The fund will invest in equity and equity related

instruments which is diversified across market

capitalization viz. Large Cap companies, Mid Cap

companies and Small Cap companies spread across

sectors.

The Fund Manager will generally invest in a few selected

sectors, which in the opinion of the fund manager have

potential to grow.

OUTLOOK

Q3 FY22 results have been largely encouraging, demand

remained strong while, EBIDTA margin has compressed

largely on account of the inflation across commodities.

However, lower finance costs and robust cash

generation has boosted profitability. Indian corporates,

including Banks, enter FY23 with the strongest balance

sheet probably since FY12.

Near term worries post the Ukraine-Russia conflict have

stoked fears of further dislocation in supply chain,

especially Gas, key industrial Metals and Agri

Commodities. As a result, commodity prices have

soared, with Brent crossing $110/barrel levels. This

could affect inflation in the coming months. In this

context, a swift resolution to peace could be critical, as

levers to boost supply of these commodities from RoW

remain limited. The ferocity of the move in inflation

could dampen investor sentiments. For equity investors,

conflicts and wars have been phases of mixed emotion –

during the crisis, regret of being fully invested (RoFI)

and once past the crisis, regret of missed opportunities

(FOMO). Looking back, continuing with one’s equity

investments through such crisis generally has been the

ideal strategy.

FUND FEATURES: (Data as on 28th February'22)

Category: Multi Cap

Monthly Avg AUM: Rs844.12 Crores

Inception Date: 2 December, 2021

Fund Manager:

Mr. Daylynn Pinto

(equity portion), Mr. Harshal Joshi

(debt portion)

Benchmark: NIFTY 500 Multicap

50:25:25 TRI

SIP (Minimum Amount): Rs100/- and in

multiples of Re. 1 thereafter

Exit Load:

If redeemed/switched out within 1 year

from the date of allotment -1% of

applicable NAV; If redeemed/switched

out after 1 year from the date of

allotment –Nil

SIP Frequency: Monthly

SIP Dates (Monthly): Investor may

choose any day of the month except

29th, 30th and 31st as the date of

instalment.

Options Available: Growth, IDCW@ -

(Payout of Income Distribution cum

capital withdrawal option, Reinvestment

of Income Distribution cum

capital withdrawal option & Transfer of

Income Distribution cum capital

withdrawal plan (from Equity Schemes

to Debt Schemes Only).

| PORTFOLIO | (28 February 2022) |

| Name of the Instrument | Ratings | % of NAV |

| Equity and Equity related Instruments | 83.27% | |

| Banks | 12.19% | |

| HDFC Bank | 3.19% | |

| ICICI Bank | 2.69% | |

| Axis Bank | 2.06% | |

| Bank of Baroda | 1.80% | |

| Canara Bank | 1.33% | |

| Kotak Mahindra Bank | 1.11% | |

| Software | 10.18% | |

| Tata Consultancy Services | 2.58% | |

| Cyient | 1.97% | |

| Infosys | 1.66% | |

| HCL Technologies | 1.50% | |

| Zensar Technologies | 1.26% | |

| MphasiS | 1.13% | |

| C.E. Info Systems | 0.09% | |

| Pharmaceuticals | 9.23% | |

| IPCA Laboratories | 2.02% | |

| Laurus Labs | 1.96% | |

| Divi's Laboratories | 1.80% | |

| Sun Pharmaceutical Industries | 1.73% | |

| Dr. Reddy's Laboratories | 1.72% | |

| Consumer Non Durables | 6.91% | |

| Avanti Feeds | 1.96% | |

| United Breweries | 1.91% | |

| Tata Consumer Products | 1.74% | |

| ITC | 1.30% | |

| Cement & Cement Products | 5.53% | |

| The Ramco Cements | 2.09% | |

| JK Lakshmi Cement | 1.99% | |

| Grasim Industries | 1.45% | |

| Finance | 5.07% | |

| HDFC | 1.71% | |

| SBI Cards and Payment Services | 1.70% | |

| LIC Housing Finance | 1.66% | |

| Auto Ancillaries | 4.75% | |

| Bosch | 2.09% | |

| Automotive Axles | 1.43% | |

| Tube Investments of India | 1.23% | |

| Industrial Products | 3.50% | |

| Bharat Forge | 1.80% | |

| Graphite India | 1.69% | |

| Consumer Durables | 3.15% | |

| Greenply Industries | 1.84% | |

| Metro Brands | 1.31% | |

| Auto | 2.79% | |

| Hero MotoCorp | 1.84% | |

| Mahindra & Mahindra | 0.96% | |

| Entertainment | 2.77% | |

| PVR | 2.77% | |

| Petroleum Products | 2.57% | |

| Reliance Industries | 2.57% | |

| Ferrous Metals | 2.05% | |

| Jindal Steel & Power | 2.05% | |

| Leisure Services | 1.88% | |

| EIH | 1.88% | |

| Power | 1.70% | |

| Kalpataru Power Transmission | 1.70% | |

| Chemicals | 1.63% | |

| Tata Chemicals | 1.63% | |

| Construction | 1.59% | |

| Mahindra Lifespace Developers | 1.59% | |

| Construction Project | 1.43% | |

| Larsen & Toubro | 1.43% | |

| Gas | 1.41% | |

| Gujarat Gas | 1.41% | |

| Insurance | 1.35% | |

| Bajaj Finserv | 1.35% | |

| Telecom - Services | 1.00% | |

| Bharti Airtel | 1.00% | |

| Industrial Capital Goods | 0.60% | |

| CG Power and Industrial Solutions | 0.60% | |

| Net Cash and Cash Equivalent | 16.73% | |

| Grand Total | 100.00% |

SECTOR ALLOCATION

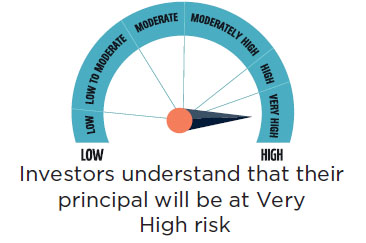

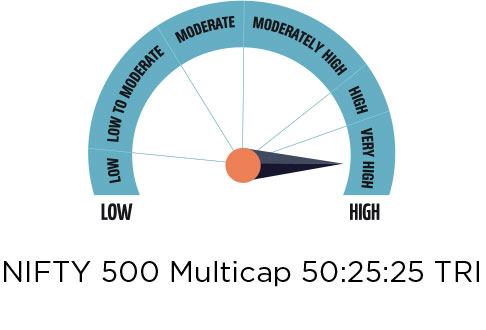

RISKOMETER

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To generate short-term optimal returns.

• Investment in a portfolio of large, mid and small cap equity and equity

related securities.

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |