IDFC BANKING & PSU DEBT FUND

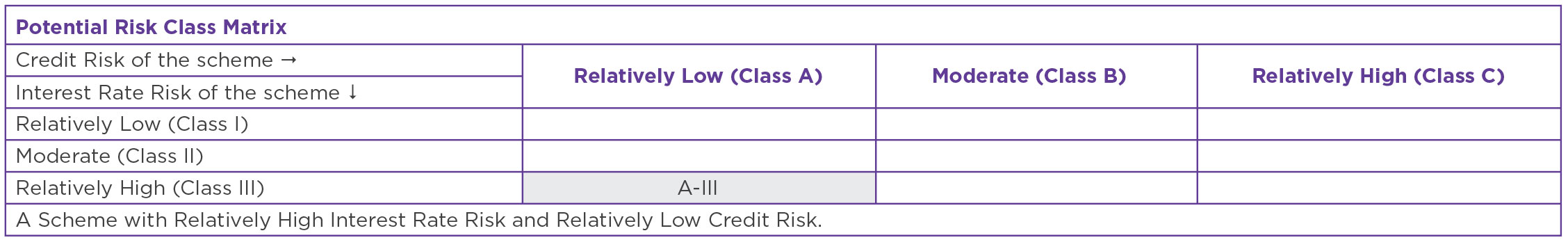

An open ended debt scheme predominantly investing in debt instruments

of banks, Public Sector Undertakings, Public Financial Institutions and

Municipal Bonds. A Scheme with Relatively High Interest Rate Risk and

Relatively Low Credit Risk.

IDFC BANKING & PSU DEBT FUND

An open ended debt scheme predominantly investing in debt instruments

of banks, Public Sector Undertakings, Public Financial Institutions and

Municipal Bonds. A Scheme with Relatively High Interest Rate Risk and

Relatively Low Credit Risk.

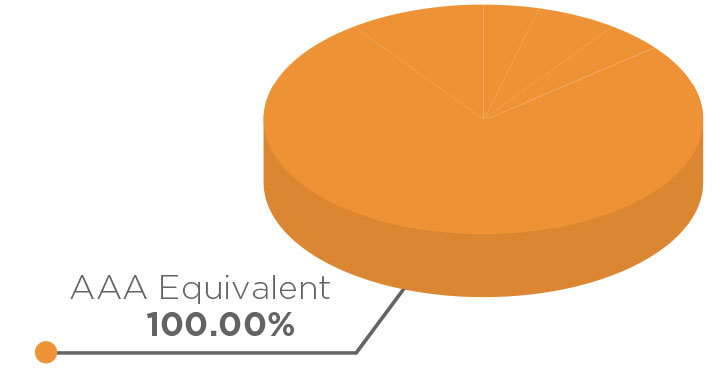

• A portfolio that emphasizes on high quality

instruments. currently 100% AAA and equivalent

instruments.

• By investing in one single fund you get to diversify your

allocation into multiple high quality instruments issued

by banks, PSUs (Public Sector Undertakings), PFIs

(Public Financial Institutions) and Municipal Bonds.

• Ideal to form part of ‘Core’ Bucket – due to its high

quality and low to moderate duration profile*

FUND FEATURES: (Data as on 28th February'22)

Category: Banking and PSU

Monthly Avg AUM: Rs17,996.13 Crores

Inception Date: 7th March 2013

Fund Manager: Mr. Suyash Choudhary

(w.e.f. 28th July 2021) Mr. Gautam Kaul

(w.e.f. 1st Dcember 2021)

Standard Deviation (Annualized): 0.90%

Modified duration 1.00 years

Average Maturity: 1.09 years

Macaulay Duration: 1.05 years

Yield to Maturity: 4.77%

Benchmark: NIFTY Banking & PSU Debt

Index (w.e.f 11/11/2019)

Minimum Investment Amount: Rs5,000/- and any amount thereafter

Exit Load: Nil (w.e.f. 12th June 2017)

Options Available : Growth, IDCW@

- Daily, Fortnightly, Monthly

(Reinvestment), Quarterly (Payout),

Annual (Payout) & Periodic (Payout &

Reinvestment)

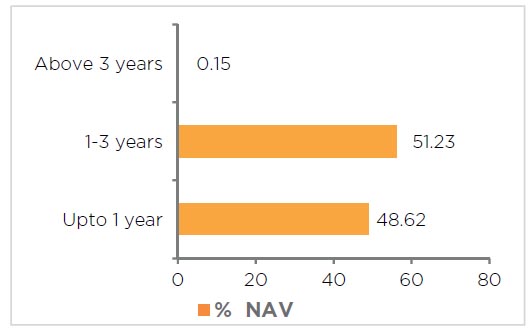

Maturity Bucket:

@Income Distribution cum capital withdrawal

| PORTFOLIO | (28 February 2022) |

| Name | Rating | Total (%) |

| Corporate Bond | 73.44% | |

| NABARD | AAA | 10.78% |

| HDFC | AAA | 7.56% |

| Indian Railway Finance Corporation | AAA | 6.45% |

| REC | AAA | 6.28% |

| Axis Bank | AAA | 5.59% |

| Hindustan Petroleum Corporation | AAA | 5.27% |

| Power Finance Corporation | AAA | 5.02% |

| National Housing Bank | AAA | 3.95% |

| Small Industries Dev Bank of India | AAA | 3.28% |

| ICICI Bank | AAA | 2.90% |

| Export Import Bank of India | AAA | 2.76% |

| National Highways Auth of Ind | AAA | 2.00% |

| Power Grid Corporation of India | AAA | 1.92% |

| Housing & Urban Development Corporation | AAA | 1.69% |

| LIC Housing Finance | AAA | 1.60% |

| Reliance Industries | AAA | 1.44% |

| Indian Oil Corporation | AAA | 1.26% |

| NTPC | AAA | 1.21% |

| NHPC | AAA | 0.92% |

| Larsen & Toubro | AAA | 0.86% |

| Oil & Natural Gas Corporation | AAA | 0.41% |

| Bajaj Finance | AAA | 0.28% |

| Tata Sons Private | AAA | 0.01% |

| Certificate of Deposit | 9.76% | |

| Bank of Baroda | A1+ | 4.02% |

| Axis Bank | A1+ | 2.48% |

| Export Import Bank of India | A1+ | 1.34% |

| HDFC Bank | A1+ | 1.10% |

| Canara Bank | A1+ | 0.82% |

| Government Bond | 7.63% | |

| 7.37% - 2023 G-Sec | SOV | 3.39% |

| 7.32% - 2024 G-Sec | SOV | 2.45% |

| 7.16% - 2023 G-Sec | SOV | 0.80% |

| 4.26% - 2023 G-Sec | SOV | 0.67% |

| 7.68% - 2023 G-Sec | SOV | 0.20% |

| 8.13% - 2022 G-Sec | SOV | 0.11% |

| State Government Bond | 2.21% | |

| 6.20% Madhya Pradesh SDL - 2023 | SOV | 1.13% |

| 9.25% Haryana SDL - 2023 | SOV | 0.30% |

| 8.10% Tamil Nadu SDL - 2023 | SOV | 0.29% |

| 5.41% Andhra Pradesh SDL - 2024 | SOV | 0.14% |

| 5.68% Maharashtra SDL - 2024 | SOV | 0.08% |

| 7.93% Chattisgarh SDL - 2024 | SOV | 0.06% |

| 8.62% Maharashtra SDL - 2023 | SOV | 0.06% |

| 7.95% Tamil Nadu SDL - 2023 | SOV | 0.03% |

| 7.77% Gujarat SDL - 2023 | SOV | 0.03% |

| 7.77% Tamil Nadu SDL - 2023 | SOV | 0.03% |

| 7.62% Tamil Nadu SDL - 2023 | SOV | 0.03% |

| 5.93% ODISHA SDL - 2022 | SOV | 0.02% |

| 8.48% Tamilnadu SDL - 2023 | SOV | 0.01% |

| Commercial Paper | 1.09% | |

| HDFC | A1+ | 0.55% |

| Small Industries Dev Bank of India | A1+ | 0.54% |

| Floating Rate Note | 0.17% | |

| Kotak Mahindra Bank | A1+ | 0.17% |

| Zero Coupon Bond | 0.02% | |

| LIC Housing Finance | AAA | 0.02% |

| Net Cash and Cash Equivalent | 5.70% | |

| Grand Total | 100.00% |

ASSET QUALITY

POTENTIAL RISK CLASS MATRIX

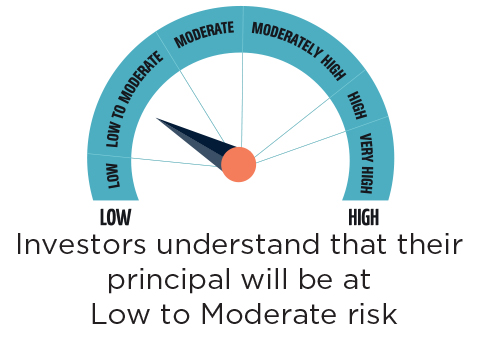

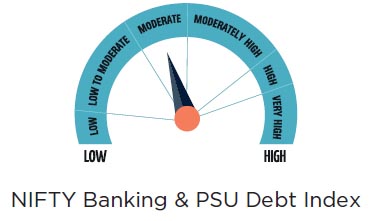

RISKOMETER

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To generate optimal returns over short to medium term

• Investments predominantly in debt & money market instruments

issued by PSU, Banks & PFI

*Investors should consult their financial advisors if in doubt

about whether the product is suitable for them.

This scheme has exposure to floating rate instruments and / or interest rate derivatives. The duration of these instruments is linked to the interest rate reset period. The interest rate risk in a floating rate instrument or in a fixed rate instrument hedged with derivatives is likely to be lesser than that in an equivalent maturity fixed rate instrument. Under some market circumstances the volatility may be of an order greater than what may ordinarily be expected considering only its duration. Hence investors are recommended to consider the unadjusted portfolio maturity of the scheme as well and exercise adequate due diligence when deciding to make their investments.

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |