IDFC CREDIT RISK FUND

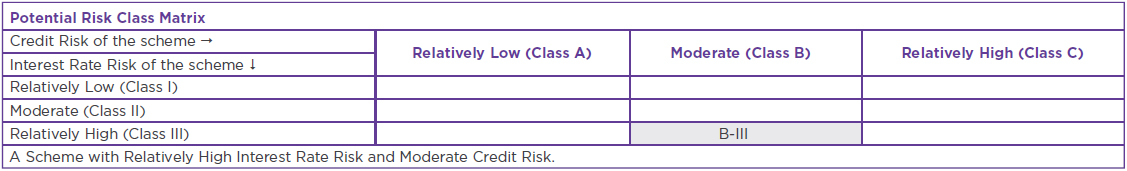

An open ended debt scheme predominantly investing in AA and below rated corporate bonds. A Scheme with Relatively High Interest Rate Risk and Moderate Credit Risk

IDFC CREDIT RISK FUND

An open ended debt scheme predominantly investing in AA and below rated corporate bonds. A Scheme with Relatively High Interest Rate Risk and Moderate Credit Risk

IDFC Credit Risk Fund fund aims to provide an optimal risk-reward profile to investors by focusing on companies with well-run management and evolving business prospects or good businesses with improving financial profile.

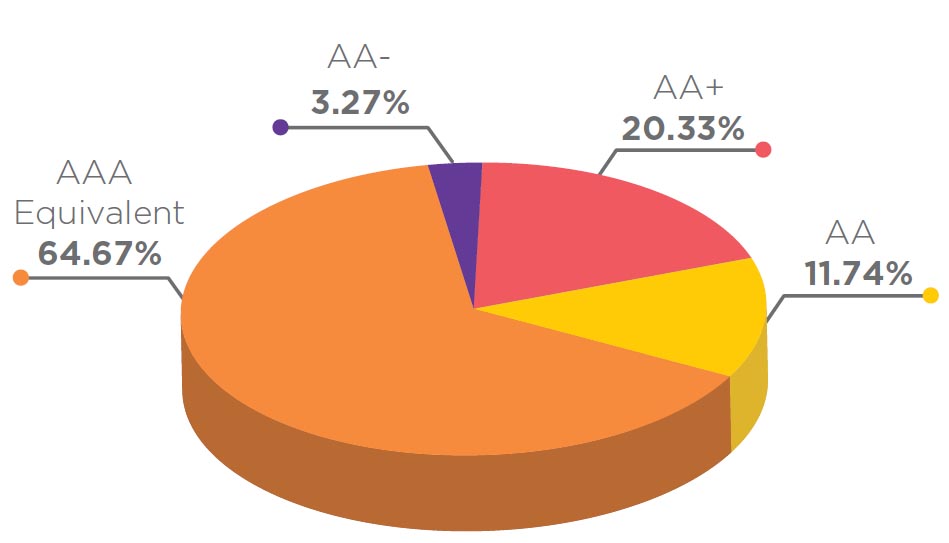

ASSET QUALITY

FUND FEATURES: (Data as on 28th February'22)

Category: Credit Risk

Monthly Avg AUM: Rs775.94 Crores

Inception Date: 3rd March 2017

Fund Manager: Mr. Arvind Subramanian (w.e.f. 03rd March 2017)

Standard Deviation (Annualized): 0.97%

Modified duration: 2.40 Years

Average Maturity: 3.20 years

Macaulay Duration: 2.53 years

Yield to Maturity: 5.55%

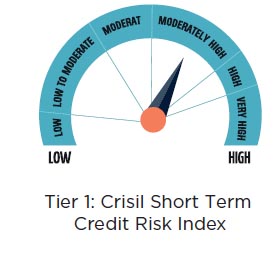

Benchmark: Tier 1: Crisil Short Term

Credit Risk Index (w.e.f. 1st Dec, 2021)

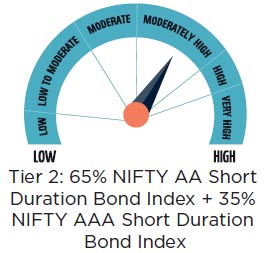

Tier 2: 65% NIFTY AA Short Duration

Bond Index + 35% NIFTY AAA Short

Duration Bond Index

Exit Load: 1% if redeemed/switched

out within 365 days from the date of

allotment

Options Available: Growth, IDCW@

- Quarterly, Half yearly, Annual and

Periodic (Payout, Reinvestment &

Sweep facility)

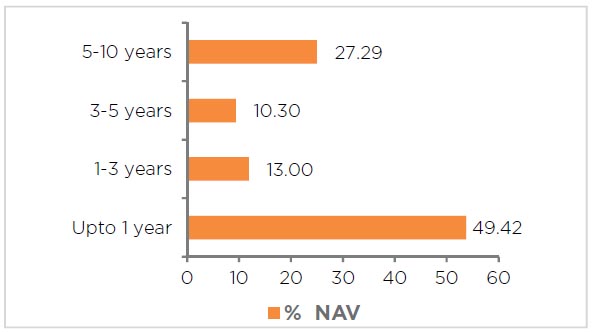

Maturity Bucket:

@Income Distribution cum capital withdrawal

| PORTFOLIO | (28 February 2022) |

| Name | Rating | Total (%) |

| Corporate Bond | 56.45% | |

| Tata Power Renewable Energy* | AA(CE) | 6.52% |

| Bharti Hexacom | AA+ | 6.48% |

| Reliance Industries | AAA | 6.45% |

| Summit Digitel Infrastructure Private | AAA | 6.39% |

| National Highways Auth of Ind | AAA | 6.20% |

| Tata Steel | AA+ | 5.96% |

| Hindalco Industries | AA+ | 5.26% |

| IndusInd Bank@ | AA | 4.54% |

| Tata Motors | AA- | 3.27% |

| Indian Bank@ | AA+ | 2.62% |

| Indian Railway Finance Corporation | AAA | 1.39% |

| HDFC | AAA | 0.68% |

| Tata Power Company | AA | 0.67% |

| Government Bond | 14.52% | |

| 7.17% - 2028 G-Sec | SOV | 13.24% |

| 5.22% - 2025 G-Sec | SOV | 1.28% |

| PTC | 7.68% | |

| First Business Receivables Trust^ | AAA(SO) | 7.68% |

| Net Cash and Cash Equivalent | 21.34% | |

| Grand Total | 100.00% |

(PTC originated by Reliance Industries Limited)

#Corporate Guarantee from Tata Power

@AT1 Bonds under Basel III

POTENTIAL RISK CLASS MATRIX

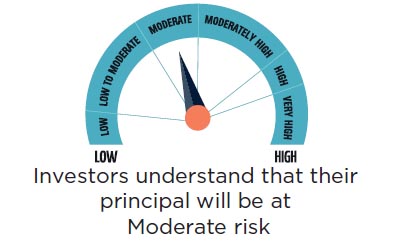

RISKOMETER

Scheme risk-o-meter

Benchmark risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To generate optimal returns over medium to long term

• To predominantly invest in a portfolio of corporate

debt securities across the credit spectrum

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

Gsec/SDL yields have been annualized wherever applicable

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |