IDFC GOVERNMENT SECURITIES FUND-INVESTMENT PLAN

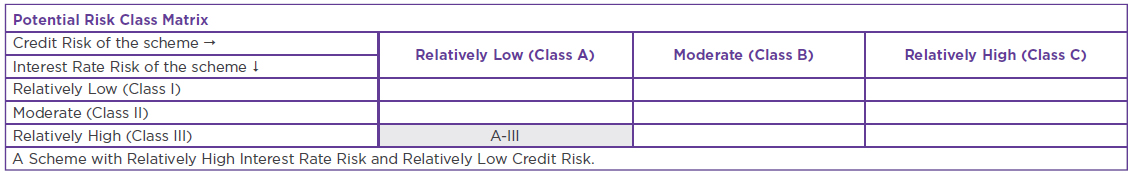

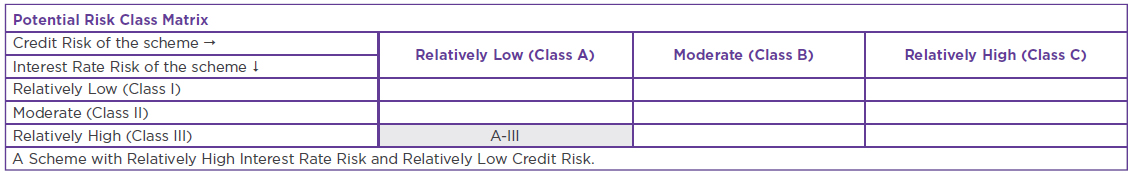

An open ended debt scheme investing in government securities across maturities. A Scheme with Relatively High Interest Rate Risk and Relatively Low Credit Risk

IDFC GOVERNMENT SECURITIES FUND-INVESTMENT PLAN

An open ended debt scheme investing in government securities

across maturities.

A Scheme with Relatively High Interest Rate Risk and Relatively Low

Credit Risk.

• A satellite bucket product which emphasizes on

high-quality instruments and invests only in

sovereign securities.

• The fund can be a mix of government bonds, state

development loans (SDLs), treasury bills and/or

cash management bills.

• A portfolio that can take exposure across the

yield curve depending upon the fund manager’s

underlying macro/interest rate view.

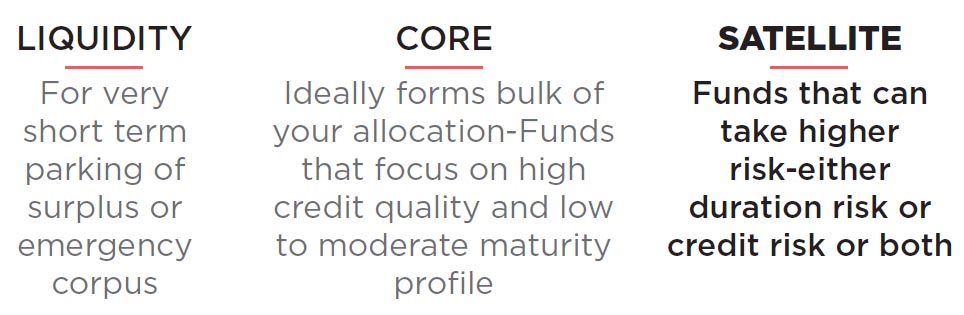

Here is a simple 3-Lens asset allocation framework

for debt mutual funds. The framework revolves

around allocating across three buckets: Liquidity,

Core, and Satellite, each bucket meeting a certain

need.

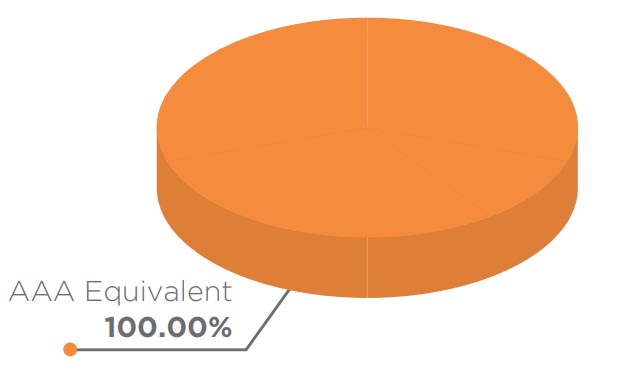

ASSET QUALITY

FUND FEATURES: (Data as on 28th February'22)

Category: Gilt

Monthly Avg AUM: Rs1,446.67 Crores

Inception Date: 9th March 2002

Fund Manager:

Mr. Suyash

Choudhary (Since 15th October 2010)

Standard Deviation (Annualized): 1.26%

Modified duration: 1.90 years

Average Maturity: 2.28 years

Macaulay Duration: 1.96 years

Yield to Maturity: 4.68%

Benchmark: CRISIL Dynamic

Gilt Index (w.e.f 01st February, 2019)

Minimum Investment Amount: Rs5,000/- and any amount thereafter.

Exit Load: Nil (w.e.f. 15th July 2011)

Options Available: Growth, IDCW@

- Quarterly, Half Yearly, Annual,

Regular & Periodic

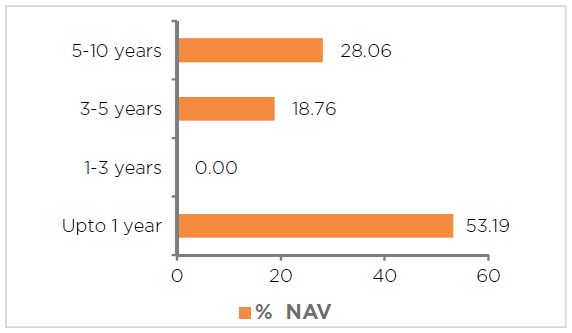

Maturity Bucket:

@Income Distribution cum capital withdrawal

| PORTFOLIO | (28 February 2022) |

| Name | Rating | Total (%) |

| Government Bond | 46.81% | |

| 6.79% - 2027 G-Sec | SOV | 28.05% |

| 5.63% - 2026 G-Sec | SOV | 18.76% |

| 7.17% - 2028 G-Sec | SOV | 0.005% |

| Net Cash and Cash Equivalent | 53.19% | |

| Grand Total | 100.00% |

ASSET QUALITY

POTENTIAL RISK CLASS MATRIX

RISKOMETER

Scheme risk-o-meter

Benchmark risk-o-meter

This product is suitable for investors who are seeking*:

• To generate long term optimal returns.

• Investments in Government Securities across maturities.

*Investors should consult their financial advisors if in doubt about

whether the product is suitable for them.

Standard Deviation calculated on the basis of 1 year history of monthly data

MUTUAL FUND INVESTMENTS ARE SUBJECT TO MARKET RISKS, READ ALL SCHEME RELATED DOCUMENTS CAREFULLY.

| Contact your Financial Advisor |

| Call toll free 1800-2-6666-88 |

Contact your Financial Advisor |  Call toll free 1800-2-6666-88 |

Invest online at www.idfcmf.com |  www.facebook.com/idfcamc |

@IDFCMF | |